Why marketing based on demographics is only part of the answer

By Chantal Rapport

You know the drill. You’re sitting at a conference, hoping for some actual business intelligence, when they introduce the keynote speaker. The first words out of her mouth? “Millennials are transforming the economy” – or some variation on that shopworn theme.

Researchers and pundits can’t stop talking about how millennials are different. In fact, there are entire gatherings devoted to marketing to this up-and-coming demographic. The overarching message: To capture millennials, you need to find, acquire and service them differently.

As a consultant and a millennial, I can tell you that’s partly correct. Generally speaking, millennials aren’t the same as other generations. But their range of buying habits and service desires may surprise you – as would those of friends and family in the Generation X and Baby Boomer segments.

Our consumer behaviour is influenced by much more than birth year. Product experience, brand awareness, purchase timing, attitudes, values and other factors all play a role. So ask yourself: How ‘millennial’ are your millennials, really?

Who are the Millennials?

Millennials, the generation born from 1981 to 1997, are the largest consumer group to enter the market since the Boomers. In Canada alone, they number some 9.5 million.

Research into this age bracket’s tastes and attitudes has become a cottage industry. Here are a few data points on Millennials:

- They are more culturally diverse than their predecessors: 36{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} of Millennials are second-generation, versus 10{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} for Gen X

- Millennials use the Internet for purchases.

- They are more comfortable with access and sharing than ownership

- Millennials delay major life events such as marriage and children.

- When they’re in stores, 57{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} use their mobile devices to compare prices

It’s all about attitude

When referring to such a diverse group, it’s wise to avoid sweeping statements. For example, Environics says that Millennials use the Internet for purchases. But the same research notes that 51{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} of them ‘go online at least once a month’. Yes, that’s more than the 29{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} of Boomers who use the Web monthly, but it still means that almost half of the so-called Internet generation doesn’t shop online.

So, which Millennials are you selling to? Do they research online but go in-store? Do they turn to a trusted adviser before making a purchase? Or do they want a clean and simple way to shop via their phone?

Chances are you have several attitudinal segments within your customer base. They will want to engage with your company in different ways, at different touch points. Their attitudes stem from experience: the way they first encountered your brand, their comfort with your product, and so on. Other attributes like income and gender also play a role.

Each attitudinal segment comes with its own set of purchase motivators and buying behaviours – and its own idea of what exceptional service means.

The Millennial trap

A client of ours wanted to grow its market reach. It was expected that to capture more incoming consumers – i.e. the Millennials – the client would need to invest in a digital offering. The mantra from professionals in the space: “Young people want to buy online”.

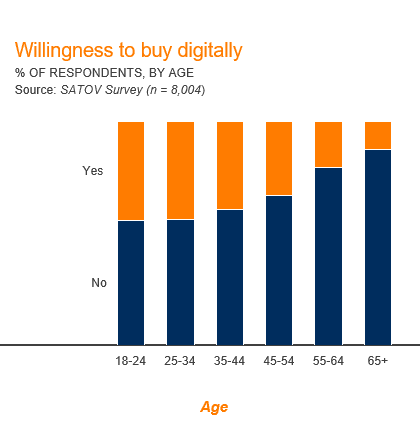

Our research showed that in the 18 to 24 and 25 to 34 age groups, only 44{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} of people were interested in purchasing the client’s product digitally. Most Millennials didn’t actually want to buy our client’s product online, a trait they shared with many older consumers in our survey.

Our research showed that in the 18 to 24 and 25 to 34 age groups, only 44{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} of people were interested in purchasing the client’s product digitally. Most Millennials didn’t actually want to buy our client’s product online, a trait they shared with many older consumers in our survey.

Experience and comfort with a product can also influence purchasing decisions. The same research showed that 37{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} of new buyers were open to purchasing online, while only 24{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} of those who had used the product before were willing to go digital.

Similar examples surround us. My colleague Alim and I are very similar, at least on paper. We graduated from the same business school, and work just three desks away from each other at the same consulting firm. We both live in Toronto’s financial district and have similar interests. But if I’m shopping for a new ultra-HD TV, I’ll seek in-person advice, whereas Alim will do his research online and place an order via email or phone.

So why do companies fall into the trap of regarding millennials as homogeneous when this generation is clearly so diverse? Because segmenting attitudinally is no easy task. Data is tough to acquire and track, and determining which attitudes are meaningful is a rigorous statistical process that involves grouping consumers into clusters.

Attitudinal segmentation 101

Luckily, we’re here to help. Follow these steps to segment by attitude:

1) Talk to your customers. Conduct primary research to understand them and their attitudes toward your product and others. Marry that information with existing data for a full picture of who your customers are and how they like to shop.

2) Identify a few key attributes that are actionable for your marketing strategy. Which channels do your customers like to be serviced through? How price-sensitive are they? What are their major product pain points?

3) Based on those attributes, separate your customers into a manageable number of segments with meaningfully different attitudes – for example, those who prefer to buy digitally. After sorting customers into groups, further describe each segment.

Maybe attitudinal segmentation will show that you’re missing out on a large digital cost-conscious segment that wants a cheaper online alternative. Now that you know that group’s preferences well, you can craft the right product, brand and channel for it.

As they say, don’t judge a book by its cover. If you pay attention to the individual, not just the year they were born, your customers will reward you.

Third party sources:

- “Millennials: the newest, biggest, and most diverse target market”, Environics Analytics

- Goldman Sachs Global Investment Research

- “Born This Way: The US Millennial Loyalty Survey”, Aimia