This Private Equity client was evaluating a consumer services company. SATOV was engaged to conduct commercial due diligence including the following work:

- Market sizing

- Consumer and customer surveys

- Competitive assessment

- Multi-jurisdiction regulatory review

We provided our client with a clear understanding of the market, consumer and competitive positioning, and growth opportunities. Following this engagement, the target was acquired.

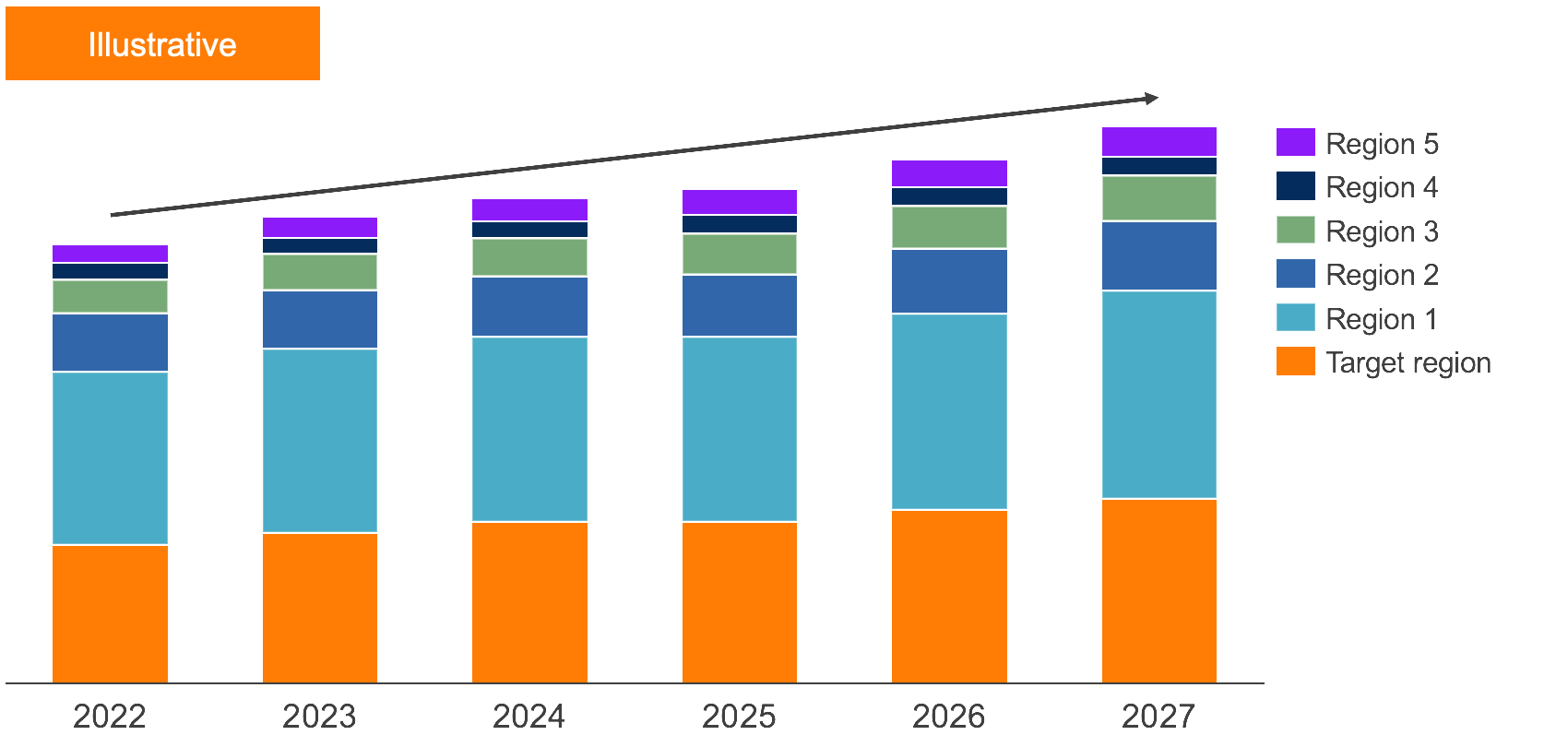

Market sizing

The target company was dominant in one large market and had yet to make inroads into others. Therefore, market sizing and opportunity assessments considered (a) growth trajectory within the current market; and (b) risks and opportunities around expanding into other territories

We determined that the market was anticipated to see low single-digit growth over the next five years (see Image 1).

Image 1. Consumer services market

$M, ANNUAL REVENUE, CANADA, 2022E-2032E

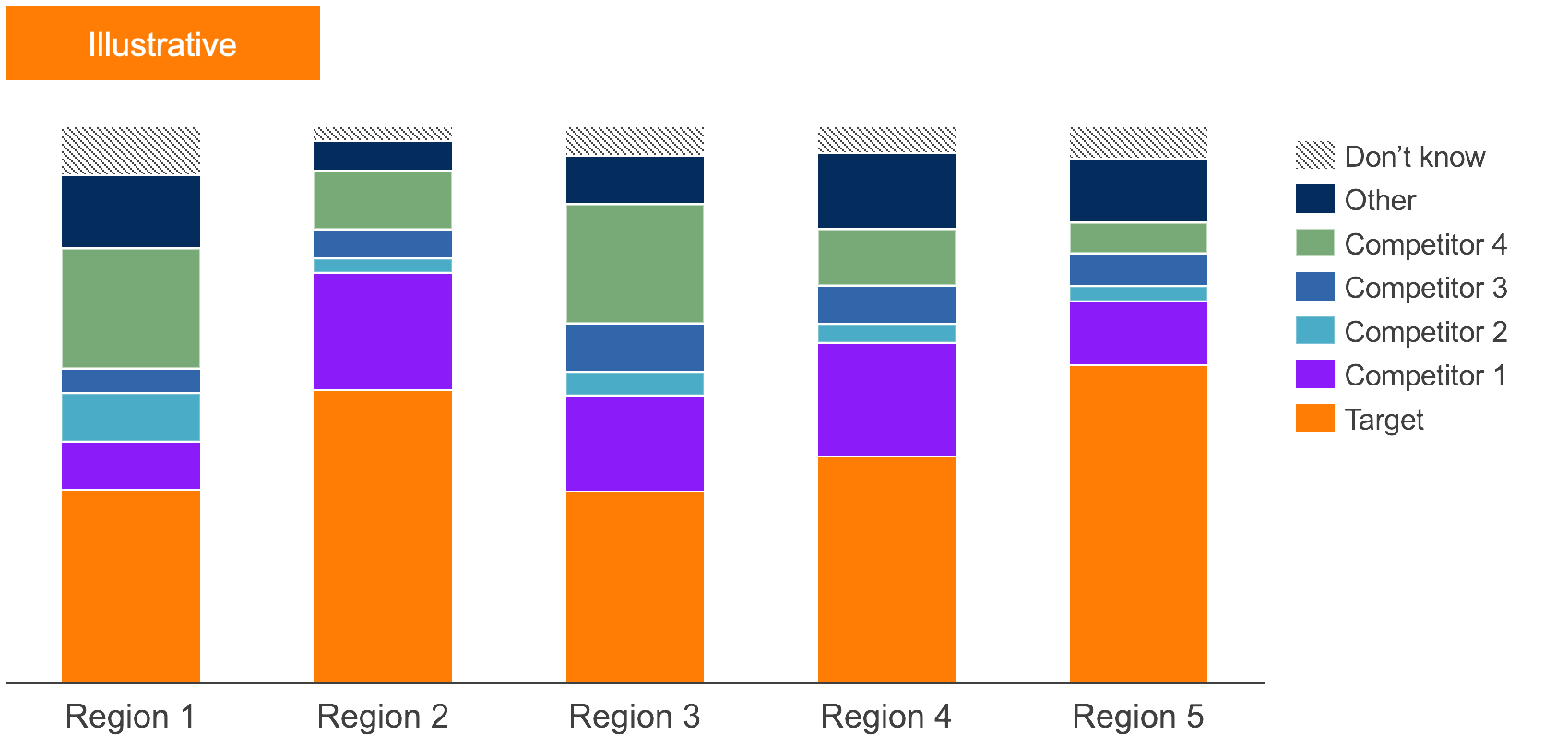

Competitive assessment

While the target was the clear leader in its current market, there were emerging competitive threats. Two of these threats demanded deeper analysis, one being a group of independent service providers operating under an association that could facilitate consumers finding and be directed to the nearest provider. We evaluated the potential for this threat to substantively materialize (see Image 2).

Image 2. Unaided awareness of service providers

Q. Please name up to three service providers you are aware of.

# OF FIRST MENTIONS FOR EACH PROVIDER

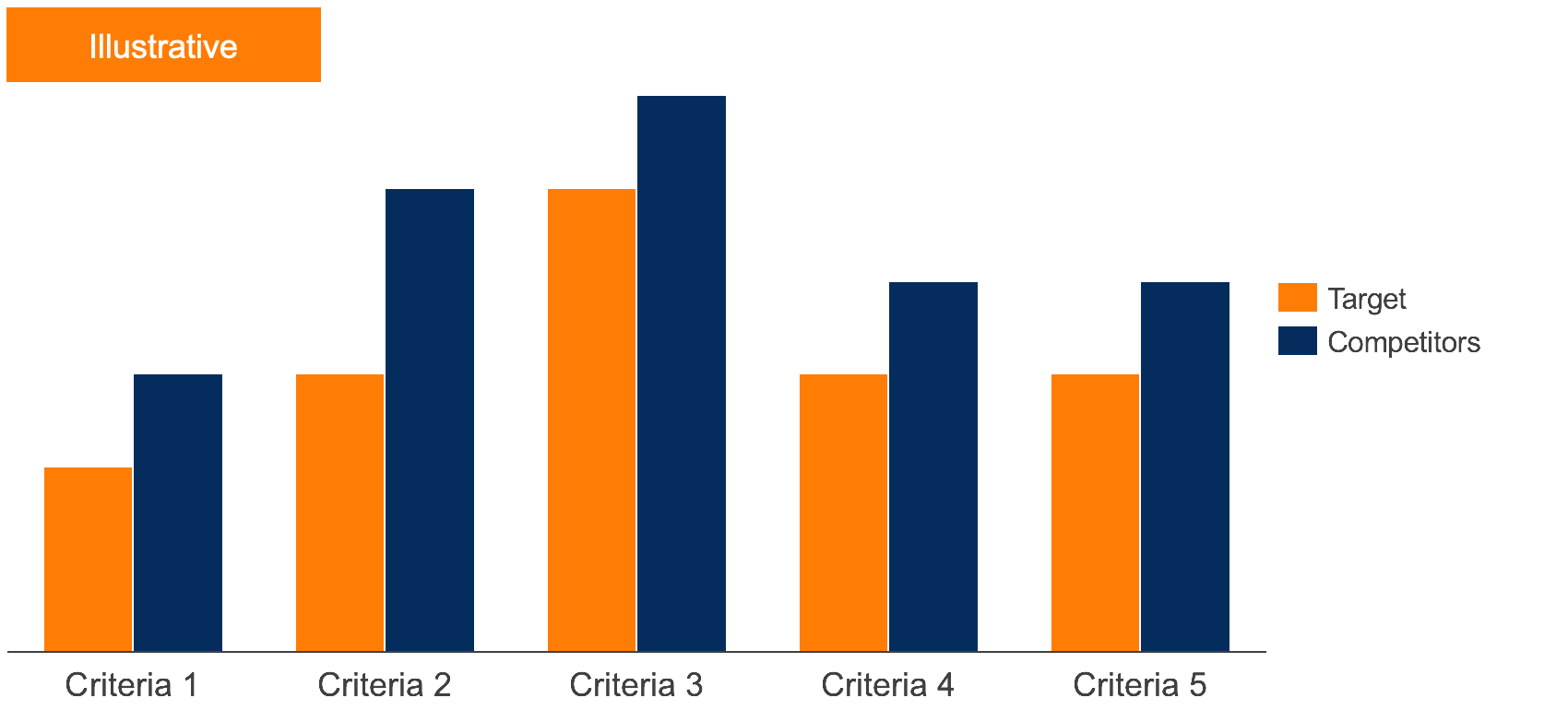

Consumer insights

For this consumer-facing brand, we assessed its strengths and weaknesses from the consumer’s perspective through primary survey research. The survey provided insights on brand awareness, brand perceptions, plus a view on the target’s market share and its top competitors. We learned for example that the target’s NPS was lower than some competitors (see Image 3), determined what was driving these scores, and how to improve.

Image 3. Company performance ratings

Q. How well did the company that you used meet each of these criteria?

% OF RESPONDENTS WHO RATED “5 – EXCELLENT”

Multi-jurisdiction regulatory review

This industry is buoyed by government regulations that have driven the market for service providers like the target. A look into current regulations in place and plans for new regulations in the target’s jurisdiction and, in others, revealed additional risks and growth opportunities (see Image 4).

Image 4. Acquisition target evaluation