Canadian-based, Aritzia, has grown into a successful global brand with a market valuation exceeding GAP, Inc. and with fewer than 1/30th the store count. Where other fashion apparel merchants have faltered over the past decade, Aritzia has gained momentum. We were interested in determining what is driving its success, whether this growth is sustainable, and what, if any, internally- or externally-driven headwinds could slow Aritzia down.

To do this, we took at look at Aritzia’s market positioning and spoke with consumers to better understand Aritzia’s performance compared to competitors, what customers think of the brand, and the defensibility of their value proposition.

Aritzia’s business model

Starting in 1984 as a standalone boutique, Aritzia now stands at 109 stores across North America. They bring a collection of in-house brands (Aritzia, Babaton, Wilfred, TNA, TnAction, Sunday Best and Super World) and partnership brands (e.g., Agolde, Levi’s, New Balance, Vans) to market through their physical and digital channels.

Benchmarking Aritzia’s market success

We started our research by verifying Aritzia’s success in the market. Aritzia’s unique positioning on the luxury spectrum created a limited list of public competitors to benchmark. We chose Lululemon, Urban Outfitters, and Abercrombie and Fitch as the competitive set because (a) they compete in the same part of the value chain as Aritzia, targeting women between the ages of 18 and 35, and (b) they are publicly traded (for the ease of gathering financial information).

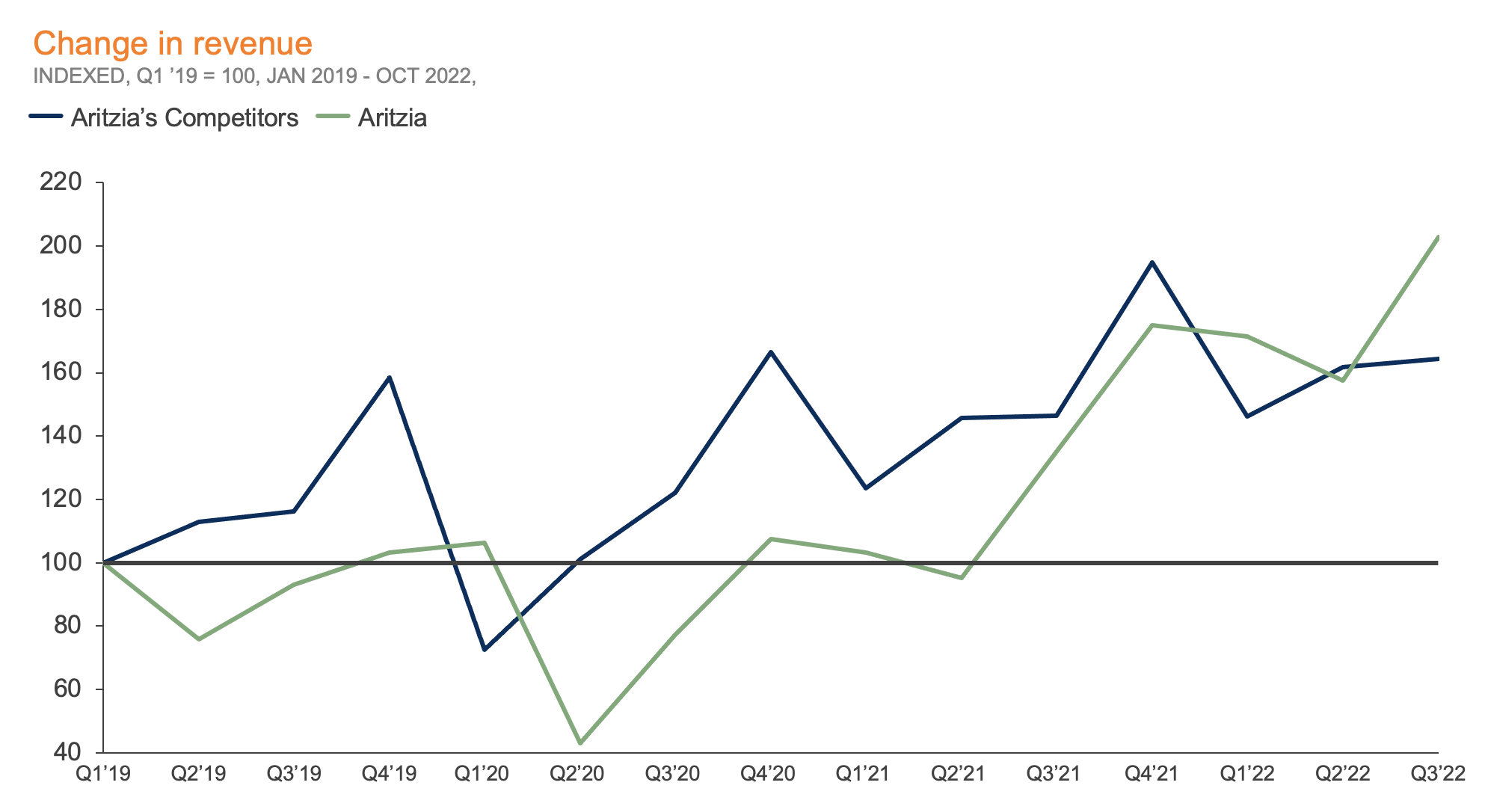

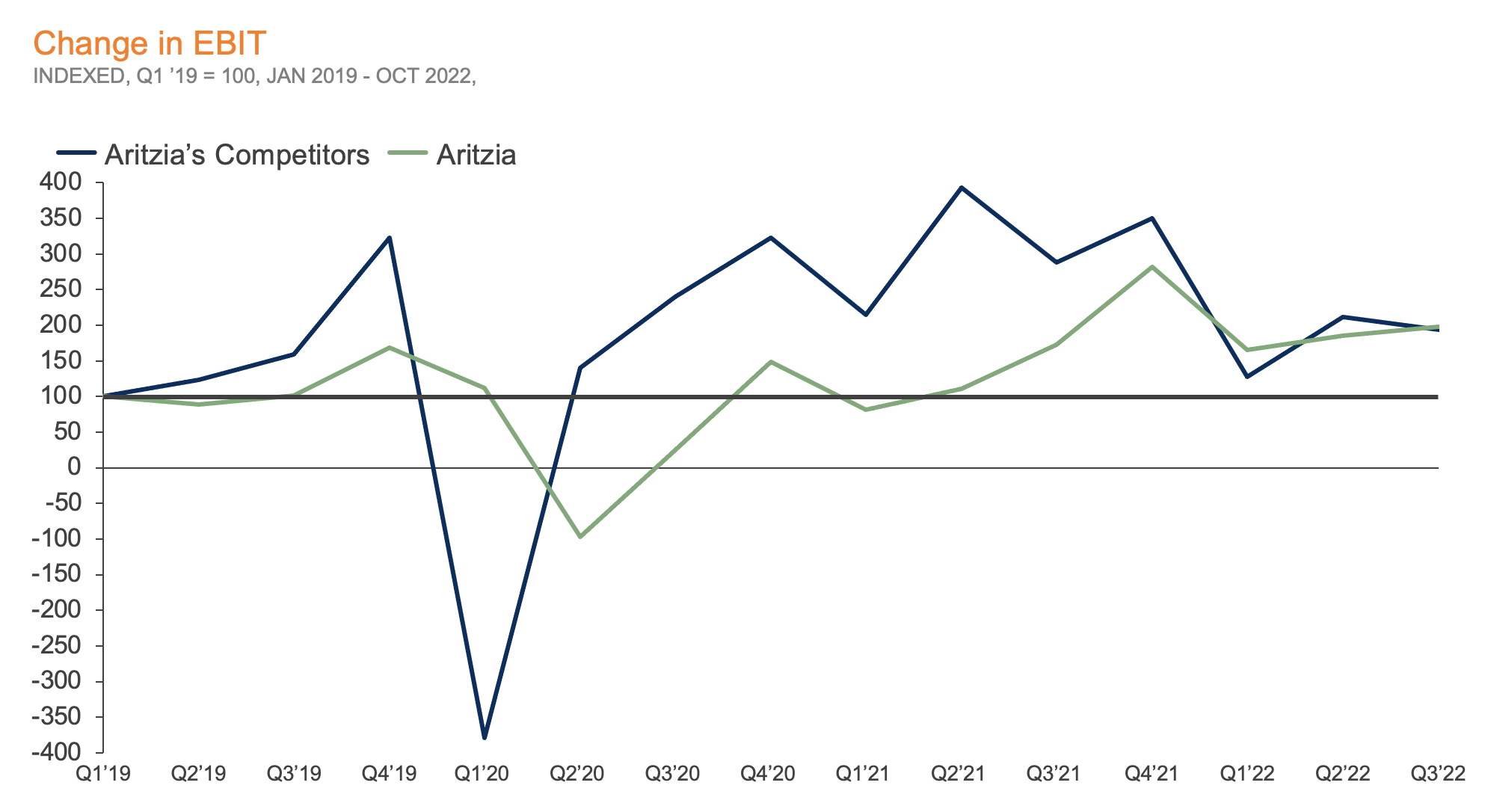

Aritzia post-COVID revenue and growth make for a strong recovery

Compared to the selected competitor retailers, Aritzia has clearly outperformed in the wake of the pandemic. For one, in the recovery from the pandemic, Aritzia’s revenues have grown at a faster rate than the average of their peers (2x since Q1 2019). What’s more, despite consumers becoming more accustomed to purchasing clothing online, especially during the pandemic, Aritzia has grown store count considerably since 2018 (6.4% CAGR). This is a striking divergence from competitors like Abercrombie and Fitch, whose store count shrank by -8.4% (CAGR).

On the other hand, Aritzia has accumulated high levels of inventory (4x Q1 2019 inventory), a challenge many retailers are facing post COVID. While this may not be ideal, Aritzia is likely in a strong position to work through inventory, given an increase in customers returning to work/events and the perceived timeless nature of their clothing.

*Note: Aritzia’s Competitors included in benchmarking are Lululemon, Urban Outfitters, and Abercrombie and Fitch.

Aritzia leads on the digital front

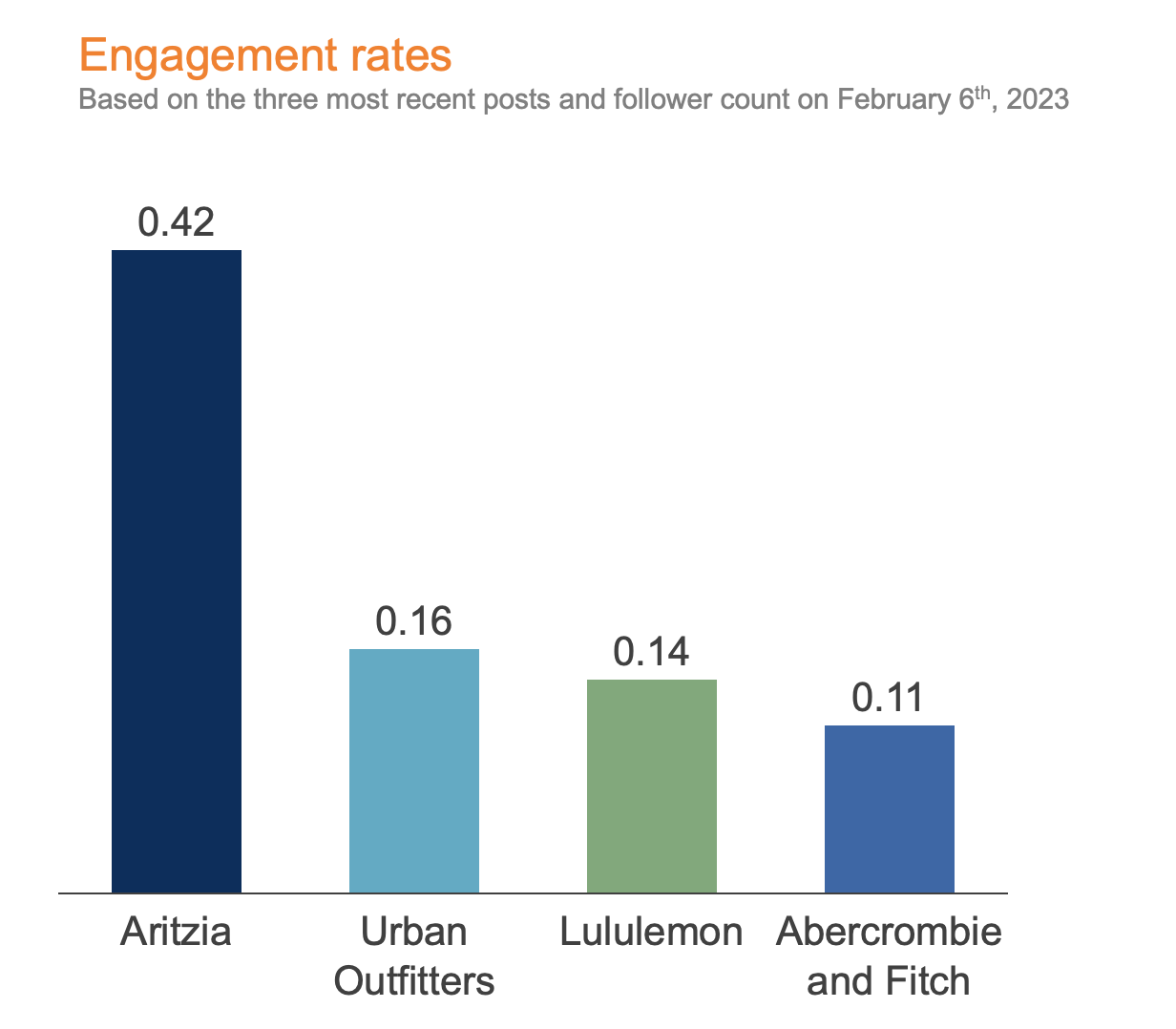

With younger target demographics, Aritzia and competitors need to capture buyers through digital channels. Google search trends and social media engagement indicate that Aritzia seems to have a strong digital presence.

Google search trends, which can reflect overall engagement with and popularity of a brand, show that since 2019, Aritzia’s search volume has increased by 3.75x. Over the same period, Lululemon’s search trends have followed suit, but Urban Outfitters’ declined, and Abercrombie and Fitch’s went up more modestly, by 2x.

To measure social media success, we looked at competitor engagement rates (likes and comments per post divided by followers) for the three most recent posts at the time of our research for each competitor. Aritzia’s engagement rate was the highest out of the competitor set, with an average engagement rate of 0.42%. Abercrombie and Fitch’s, for comparison, was 0.11%.

Overall, since 2019, Aritzia has put up impressive numbers from revenue growth to social engagement. Although the retailer may not be completely alone in its recent success – notably, Lululemon has kept up their momentum in terms of opening new stores, maintaining high search volumes, and building a loyal customer base – Aritzia’s market data certainly tells a standout story.

To better understand what it is about Aritzia that’s working for them and driving these numbers, we wanted to hear from consumers.

Understanding the consumer perspective

Why do people shop at Aritzia? Why do customers love their brand? We conducted focus groups with both Aritzia enthusiasts and infrequent shoppers in Ontario and BC to identify performance drivers.

Here are three of the things Aritzia enthusiasts love most about the brand:

- Its range of product lines

- Its product quality

- The store experience

Aritzia’s product lines balance trends and basics

Both Aritzia enthusiasts and infrequent shoppers agree that Aritzia clothes are fashionable and on-trend. Its range of product lines offers both trendy and basic clothing, which appeals to consumers.

Trendy products

Part of Aritzia’s offering consists of clothing that either reflects what’s currently in style – or will eventually become popular, just by way of being available at Aritzia.

- In keeping a flow of these new products, Aritzia is seen as the go-to to find out what new styles people are wearing, even among infrequent shoppers.

- An example of Aritzia’s trend-setting power that we heard about was the Melina pants – an Aritzia item that helped popularize vegan leather pants. (TikTok also played a role in creating this phenomenon.)

“I feel like Aritzia has tended to dictate the style trends over the last few years. Am I crazy? Like they say, okay, we’re doing square necklines now, and then it trickles down into [other stores]. If I want to know what the cool girls are wearing, ‘the cool girlies’, that’s where I’ll look.”

–Infrequent shopper

“I think of the Melina leather pant. Like, I don’t think I ever had any interest in wearing leather pants until those leather pants came out. And then after that, I think Dynamite and Abercrombie had dupes, and after that, all of them started.”

–Enthusiast

Core products

In contrast to the trendy items, the brand keeps rotation of what participants referred to as “core” or “staple” pieces – quintessential Aritzia clothing lines and items that stay in the lineup year after year.

- The core Aritzia lines are generally more basic styles that are seen as “timeless”, leading brand wearers to believe not only that they will be on-trend, but that what they buy will remain in style for the foreseeable future.

- Participants also noted that, due in part to the fact that the core items have become so recognizable, they feel comfortable shopping at Aritzia because they are nearly guaranteed to have an article of clothing that will be deemed trendy by their friends and peers.

“They keep a lot of core pieces. For example, I’m sure everyone here is very familiar with like the effortless pant. They’ve had that pant or a very similar dress pant for the last six or seven years. […] So like every year they bring in some new pieces that are a bit more trendy […]. But they keep these core pieces that are timeless and don’t really go out of style as well.”

–Enthusiast

“I’ve always felt a little bit off-trend, but like in a way, that makes me self-conscious. So, I like the safe notion of knowing if I were to go grab a dress from Aritzia or like a recognizable top from Aritzia, if people saw me in it, they’d be like, oh yes, she has her [stuff] together.”

–Infrequent shopper

Products for all aspects of life

Aritzia’s wide range of product lines make it a one-stop-shop for lovers of the brand.

- Aritzia enthusiasts love the fact that they can find everything they need at Aritzia. From everyday clothing to more formal items, Aritzia is the go-to.

- Enthusiasts also noted that their product line and brand preferences within Aritzia have changed over time. As they’ve grown up, their wardrobe needs have shifted, but Aritzia is able to follow them through each stage through their diverse product assortment.

“For me, it’s the variety. Like, being able to get athletic wear and loungewear and business casual and more formal things and dresses for events. Like, everything kind of in one place. I think that’s what I love most about it.”

–Enthusiast

“I can find any kind of outfit I’m looking for at Aritzia […]. They really kind of get every aspect of my life.”

–Enthusiast

“I also started shopping at Aritzia probably ten years ago, and I feel like because they have such a big variety of brands and like each brand kind of has its own vibe, you can kind of grow with the store. For example, I think when I was in middle school and first started shopping there, I was buying more like TNA […]. And as I’ve gotten older, I’m buying more of like Babaton, Sunday Best, and that kind of thing.”

–Enthusiast

Aritzia enthusiasts want high-quality investment pieces

Participants across groups indicated that Aritzia’s pricing can be burdensome, but we heard from all groups that shoppers are willing to pay a premium for things that will stay in their clothing rotation for a long time.

There is an aspirational element to Aritzia’s clothing that appeals to the target market. It’s not fully luxury, but it’s worth it to get the higher quality for Aritzia customers.

Enthusiasts and even some infrequent shoppers feel that it’s worth the investment to get something that would last in terms of both quality and style.

“I like how they have classic pieces that they keep in rotation because it’s nice and you can invest in something. You don’t have to worry about it going out of style. And you also know it’s like good quality, like I have some dress pants from there that I’ve had for like six or seven years and they’re like in great shape.”

–Enthusiast

“[…] If I’m going to spend $100 on my shirt, I might as well spend it somewhere that I know and trust rather than a place that I don’t.”

–Enthusiast

Aritzia’s shopping experience is tailored to its target market

Physical stores

- Store ambiance: Enthusiasts feel the store aesthetics are well-crafted and fit with their personal style. From the music played to the bags, they feel that the store is truly “for them.” The recent addition of bars or cafés at certain locations adds to the luxurious feel that they like.

- Store layout: Aritzia shoppers like that each store generally has the same layout, making it easy to find each product category. They noted that Aritzia keeps its clothing well-organized and well-displayed, which makes for an effortless shopping experience

“It makes me feel like I care about myself by not going to a box store. In big stores, you can’t find anything, it’s crowded, workers are no where to be found, and the store looks like nothing special. […] Whereas in Aritzia it’s carefully placed, legit from the music playlist to how they design the store separated by brands. […] Here’s the issue with other stores too. Their markets are way too big. [They have] men, women’s, baby. Like I came here to shop for me, not the whole fam.”

–Enthusiast

“As a person who is horrible at shopping, I freaking love going to Aritzia. It’s legit so easy to find the things I need […]. Everywhere else I go gives me a headache.”

–Enthusiast

Online store

- Website design: Participants noted that a lot of their shopping is done online, and shopping on Aritzia’s website is an enjoyable experience. Enthusiasts specifically like that it’s easy to find what you’re looking for, for instance, being able to find core items along with its variations (styles, cuts, lengths, etc.), and finding other clothes modelled in product images for easy outfit matching.

“I really like the website and the accessibility of the website. […] It’s very straightforward. […] I see all the colours, all the sizes, all the links, or like all the variations, they kind of have it in one spot. And I just think they do a really good job with the AI, and like, ‘Oh, based on your interest in this, here’s more things that are related.’ So they just keep me really in the loop there and really kind of engaged in their products.”

–Enthusiast

“It also helps that Aritzia has look books online. They legit will link every piece to an outfit like hey you like these pants? Oh by the way, this is the shirt she’s wearing, click here.”

–Enthusiast

Watch-outs

- Certain product lines are not for everyone. For some consumers, the trendy products have lead to their perception of the brand as something more akin to fast-fashion than luxury.

- Some report that quality has declined. Some, mainly infrequent shoppers, reported that Aritzia’s quality of clothing has deteriorated. Subsequently, they did not believe it is worth spending more money on their clothing over other cheaper brands, at least not on a regular basis.

- High prices lead shoppers to sometimes opt for Aritzia “dupes”. Interestingly, participants across groups mentioned that in cases where they want the Aritzia style but don’t want to foot the bill, they can and will find Aritzia “dupes” for a fraction of the price once their styles eventually trickle down to the more affordable stores, even If this means sacrificing the quality, which enthusiasts did point out.

- Sales staff interactions are sometimes negative. Two common experiences were described about shoppers’ interactions in store. (1) Being ignored by sales staff. Participants noted that there is a “we’re-too-good-for-you vibe” in stores that they find offensive. (2) Receiving inauthentic help from sales staff that pressure shoppers into purchasing.

- Not having mirrors in change rooms is not ideal for everyone. Participants pointed out that at any Aritzia location, if you want to try on clothes, you have to walk out to the common area to see them in a mirror – there are no mirrors in individual change rooms. Participants described feeling uncomfortable walking out in front of other shoppers before knowing what they look like in the clothes, and not wanting to be subjected to the sales staff giving their input.

So how can Aritzia sustain their success?

It appears Aritzia’s strongest driver creating enthusiasts is their timeless, trendy, quality staples. Additionally, based on their social media engagement, we assume the brand effectively advertises to their target market. These success attributes may be concerning for three reasons: 1) The basic, minimalist look, while perceived as timeless, is also a trend right now, and trends come and go. 2) The definition of quality is hard to measure. 3) Keeping up with social appeal is unpredictable. We watched Abercrombie and Fitch lose pace with trends and fall to negative social perceptions through multiple controversies. Given some of our participants noted negative in-store shopping experiences and quality changes, we worry about the impact this will have on the brand over time.

Aritzia may already be combating these risks through diversification of their portfolio and other initiatives. We see their in-store brands, Wilfred and Babaton, launching independent retail locations. This strategy may be in place to help increase customer lifetime value and attract net new shoppers who are unaware of the brand association. To continue their outsized growth, we believe Aritzia should be focused on optimizing their brand portfolio and creating an unparalleled customer experience:

1. Brand portfolio

- (a) How will Aritzia maximize the lifetime value of a customer?

- (i) How will Aritzia retain customers as their needs change and they age?

- (ii) How will Aritzia bolster customer wallet share?

- (b) How will Aritzia attract new customers?

- (i) Should Aritzia onboard customers earlier in their lives?

- (ii) Which demographics should Aritzia target (e.g., males)?

- (iii) Are there more opportunities up or down market?

- (c) Should Aritzia onboard customers earlier in their lives?

2. Customer experience

- (a) How can Aritzia defend their market leadership with loyalty mechanisms?

- (i) What are the optimal discounting measures?

- (ii) Is a points or discount-based loyalty program likely to drive incremental spend?

- (b) How can Aritzia optimize their shopping experience?

- (i) What is the role of a sales rep, and how are they compensated?

- (ii) How do store layouts influence buying behaviour?