Banks need millennials

The word “millennial” today is a bit like the word “gold” back in the nineteenth century. It evokes the image of a mad rush for the mother load. Hardly a company outside funeral services and adult diapers does not talk up its millennial strategy.

The frenzy is at least partially justified. Millennials make up a third of all Canadian adults.[1] They have most of their economic life still ahead of them. They are generally better educated than previous generations. Unfortunately they have a low asset base ($25K vs $251K for Gen X[2]) and they are more fickle. Social media has transformed millennial spending habits and reduced their brand loyalty.[3] Their spending power on average is also lower, with the average household income for millennials being $71,000 compared to $102,000 for Gen X[4].

For most businesses, millennials are not the most profitable customers. For some, they are not even profitable at all. They don’t spend enough today and getting them today doesn’t necessarily help in keeping them when they become profitable. Of course, some industries, like sporting goods for example, are always heavily weighted towards the young. For them millennials today are their bread and butter, just like Gen X was twenty years ago.

For Canadian banks, older generations will provide the bulk of profits for years. However, much of that business is locked down. Only 1.7%[5] of consumers per year form a new primary banking relationship. While the battle for wallet share is fierce, the bank with the primary banking relationship has the advantage. Cross-selling generally requires 1/5th to 1/10th the cost of acquiring a new customer[6].

Millennials are the future. The youngest are still just entering their banking life and are up for grabs. Others have only a limited set of products making them less sticky than older customers. Still, they are sufficiently loyal to justify the effort if the acquiring bank can do enough to cross sell them and keep them. They are about twice as likely to switch[7], but that is still only 3% per year switching banks.

The vast majority of millennials become profitable quickly. At the margin, they can contribute to amortizing the huge fixed costs banks carry today. Longer term, they will develop into the most profitable customer cohort over the next decades. The average Canadian has 7+ financial products[8] and many millennials are poised to enter the mortgage, RESP, RRSP markets. 60% of millennials are not home owners and 83% of that group expects to buy a home in the next 5 years[9]

How accretive many millennials are today depends on the marginal cost to serve. Few banking costs are truly variable: mailing, call center, underwriting, some acquisition, and a few others are mostly variable. The big cost buckets: branches, head office staff, IT infrastructure, mass marketing – these are all mostly fixed. For example, teller costs are partially scalable with volume but most of the other branch costs are fixed. For most, only dramatic changes in business volume would make any difference.

A bank growing its millennial market share by a dramatic 15% would only see a total customer count increase of about 5%

As such, it is relatively easy to get behind the idea, that most millennials are profitable for banks. This dynamic will accelerate as the market shifts to less costly channels. Most Canadians already use online banking, with only 16% stepping into branches on a weekly basis. Most Canadian banks announced restructuring and cost management initiatives in the past three years. Compensation related expense growth slowed to 3.4% year over year in FY16 compared to 7% in FY15.

Banks are right to aspire to winning with millennials. They just cannot afford to damage their brand with older, wealthier customers to do it. Boomers will inherit $750-billion over the next decade[10]. In the short term, boomers are even more important to capture and retain than millennials.

The good news is that banks do not have to be Tangerine or WealthSimple to capture their fair share of millennials

Millennials resemble the rest of the population in most respects

One of the great myths in marketing is that millennials are so different from everyone else. It is true they do share some distinct, common traits. 73% of millennials access social networking daily while this drops to 42% and 24% of Gen Xers and Boomers[11]. We also know that millennials have a somewhat higher expectation of frictionless transactions. However, millennials also vary greatly among each other in most of their attitudes towards financial services. Most banking specific attitudinal segments have close to their proportionate share of millennials.

Life stages within the millennial generation drive some of these differences. Some millennials are 19-year-old university students, single, in debt, and living off their parents. Others are in their thirties, married with children and own property. These differences can also vary based on personal attitudes. SATOV has found that at least for some financial products, millennials are just as likely as any other age cohort to prefer face-to-face service. At the same time, boomers are almost as likely as millennials to prefer fully online options.

So how can a bank become more successful with millennials when they are essentially buried within broader attitudinal segments? Are those attitudinal segments actionable with few practical means of tying individuals to their segments? Do simpler segmentation schemes that focus on specific, identifiable behaviours like credit card revolvers, still have value? How should we think about those segments in context of trying to win with millennials?

The right segmentation is a big part of the answer… but it is not simple or easy

For years, the accepted dogma was that a segmentation with more than 4 to 6 simple segments was just too complex to understand or action. But today we live in a digital world which allows us to action micro-segmentation. The high-level segments still have their place but a robust strategy and best in class tactical execution requires a more nuanced approach.

Modern segmentation is complex and requires data, technology and expertise to develop and manage. Of course, those same experts need to understand how to communicate the segmentation to less expert audiences to rally the organization and drive execution.

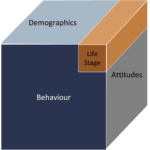

We think of segmentation as a multi-dimensional cube:

Each one of these dimensions can be actionable on a stand-alone basis.

Attitudinal segments should help us design value propositions resonating with valuable customers. The big six banks are too big to focus narrowly. The big banks have 90% share of assets invested in Canadian retail brokerage accounts[12] and 76% share of the Canadian mortgage lending market.[13] Banks must understand how the market breaks out on value proposition defining elements such as branches, online functionality, product design, etc. They must understand how many customers are in each segment, how profitable those customers are, and how many of those customers they have today.

Given that most attitudinal segments have a roughly proportional share of millennials, winning with the most valuable attitudinal segments should translate into winning with millennials as well.

Yet many leaders dismiss attitudinal segmentations as non-actionable because they are notoriously hard to link to individual customers. If strategy was knowing what offer to send to Sam on Monday afternoon, this criticism would be correct.

Attitudinal segmentations inform the “build it and they will come” part of the strategy. The other dimensions of the segmentation cube help us with tactical execution.

Behavioural segments can be product specific (e.g. credit card behaviour) or holistic. In either case, they are useful in helping us design customer level tactics. Which customers are the most profitable? Which products are they likely to need next? How will they respond to a credit increase offer? Answers to these types of questions allow us to drive immediate bottom line impact.

We can derive the segments from the bank’s own data and tag every customer to a segment. We can also monitor their behaviour and shift their segment designations over time.

Online tools, machine learning and other analytics allow businesses to work with behavioural segments of one to design offers and messages.

Demographic segments, which can include age, life stage, earning power, wealth, geography, education, immigration status, etc. are also actionable. They can also be univariate (recent immigrants from China) or multivariate (millennial recent immigrants from China with a university degree)

We can use these segments to identify our own customers or find new ones. Demographic segments often vary in factors such as media consumption. If we want to target millennials or Chinese millennials more specifically, we can now do that. We can target them with products they are likely to need given factors like life stage or immigration status. We can fine-tune our messaging to language and imagery likely to resonate with each demographic.

We can do all this while relying on the value propositions we designed for our attitudinal segments. We can do this because we know that these demographic segments are represented within those attitudinal segments.

Ideally, we could tag customers to each intersect point in our segmentation cube. In the perfect world, we could send a customized offer to a Chinese millennial whom we know to be a credit card revolver and a high touch service seeker (illustrative attitudinal segment).

We can usually cross the demographic and behavioural segments easily. Banks have the behavioural data and most of the demographic data. The challenge is incorporating attitudinal segments in the mix.

Our experience shows that most attitudinal segmentations do not link strongly to demographics. We always hope to find such links but we can never count on one when we start.

The lack of linkage between attitudes and behaviours seems even more counterintuitive than the lack of linkage between attitudes and demographics. A few examples can clear up the confusion. Customers may buy the same product (behaviour) for different reasons (attitudes). They can buy the same product (behaviour) but want to buy it in a different way (attitude). Two customers can continuously revolve their credit card debt (behaviour) but for different reasons and have different service expectations (attitudes).

The key to matching attitudinal segments to other segments is prioritization. We need to ask ourselves which links are the easiest to get and which ones would be the most valuable. For example, we can aim to identify millennials with a university education in our two most important attitudinal segments.

We can then chip away at those specific linkages over time. We can link some online behaviours to some attitudinal segments by implication. We can use short surveys to have customers self-define on some attitudinal dimension. We can derive probabilities based on responsiveness to different types of messages. None of these approaches will be perfect but we can get there with a focused effort over time.

Banks do not need a millennial strategy to win with millennials – they just need a winning strategy

Millennials are like most customers in most respects. They have diverse attitudes and needs. A sub-brand based on elements that millennials skew towards could help banks gain a few more millennials, but even existing sub-brands like Tangerine haven’t attracted a significant share of them. These sub-brands don’t attract just millennials either. To win with millennials, banks need to win with the broader market. Still, banks have room to gain more than their fair share of millennials, mostly through targeted communications. A sophisticated, multidimensional segmentation can help a bank do better with millennials or with any other target demographic.

[1] Environics: Millennials: The Newest, Biggest and Most Diverse Target Market

[2] ibid

[3] Business2Community: Why Are Millennials So Fickle With Their Brand Loyalty

[4] Environics: Millennials: The Newest, Biggest and Most Diverse Target Market

[5] Bain: Customer Loyalty in Retail Banking

[6] Financial Brand: Financial Brand: No Loyalty? Millennials Not Afraid to Dump Their Banks

[7] Accenture: Banking Shaped by the Cusomer

[8] Financial Brand: How Banks Can Snag More Wallet Share In The Next 12 Months

[9] HSBC: Beyond the Bricks

[10] CIBC: The Looming Bequest Boom

[11] Environics: Millennials: The Newest, Biggest and Most Diverse Target Market

[12] The Globe and Mail: How the Big Six banks won the battle for Canadians’ wealth

[13] CCUA: 2016 Credit Union Community & Economic Impact Report