Case summary

This private equity client was evaluating an environmental contracting company that provides abatement services for hazardous materials found in buildings across the country.

SATOV was engaged to conduct a commercial due diligence to equip the client with a clear understanding of the market, consumer perspectives, and competitive positioning, as well as potential growth avenues.

We provided detailed market sizing, evaluated the competitive and regulatory landscape, and identified adjacency opportunities in other verticals.

Our work helped our client make a confident, informed decision to acquire the asset.

This case summary outlines the four major steps we took to execute this commercial due diligence.

1. We determined the Canadian market size

The target’s business focused primarily on removing hazardous materials from buildings ranging from residential, to commercial, to industrial.

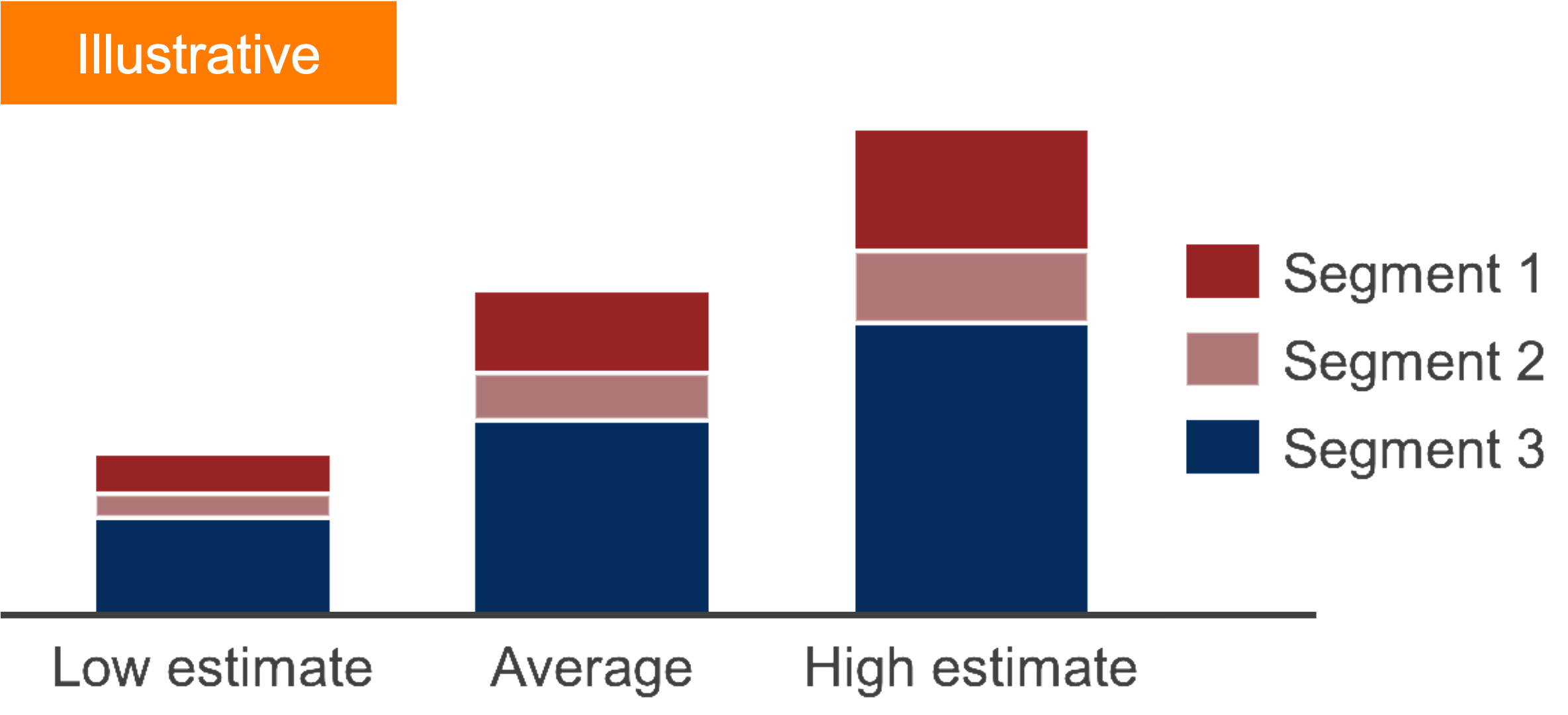

We first found out how much hazardous material is removed annually in each segment (see Chart 1).

We conducted expert interviews and looked at research reports, real estate reports, and other secondary sources to find out how many potential buyers were in the market, and how many buildings would require abatement services in each segment.

Chart 1. Estimated market for remediation and abatement

2. We estimated runway for additional demand

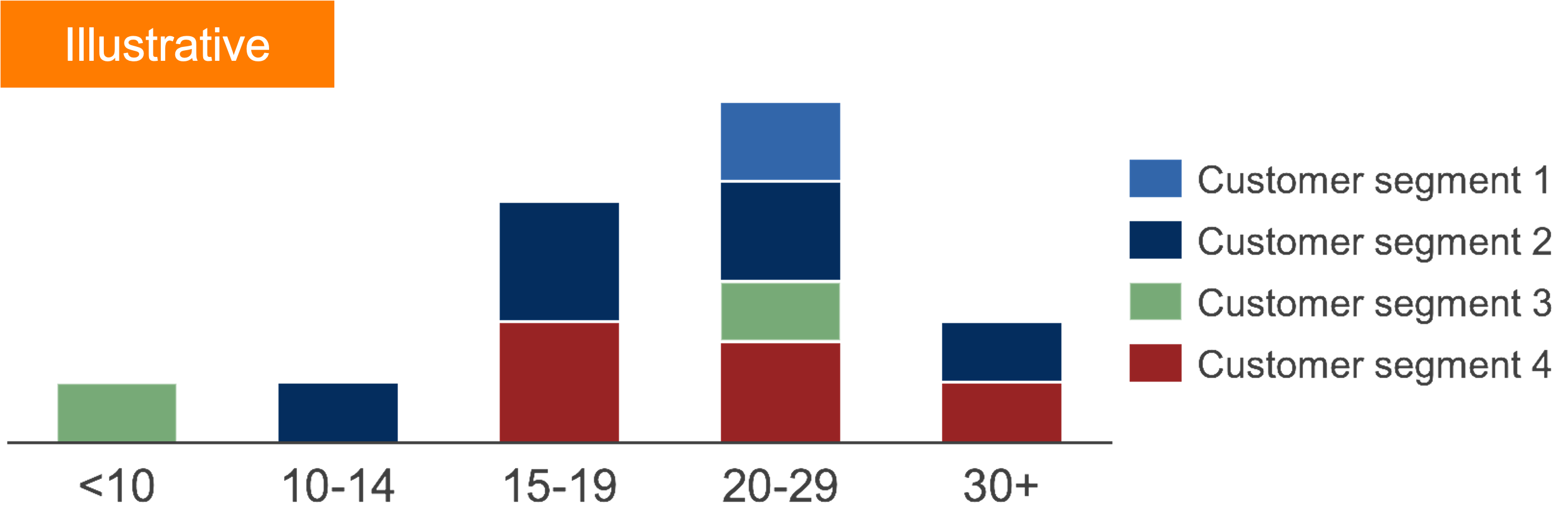

An important factor we had to consider when calculating market size was that some hazardous material exists in finite quantities.

Therefore, simply knowing the size of the current market is insufficient. We had to calculate the amount of material left that would eventually need to be removed in each building.

We reviewed building reports and spoke with experts to estimate how much of this environmental abatement work there is left to be done (see Chart 2).

Chart 2. Years of material removal work remaining by segment

Q: How many years of runway are left in this industry?

3. We assessed competitive landscape and customer recognition of industry players

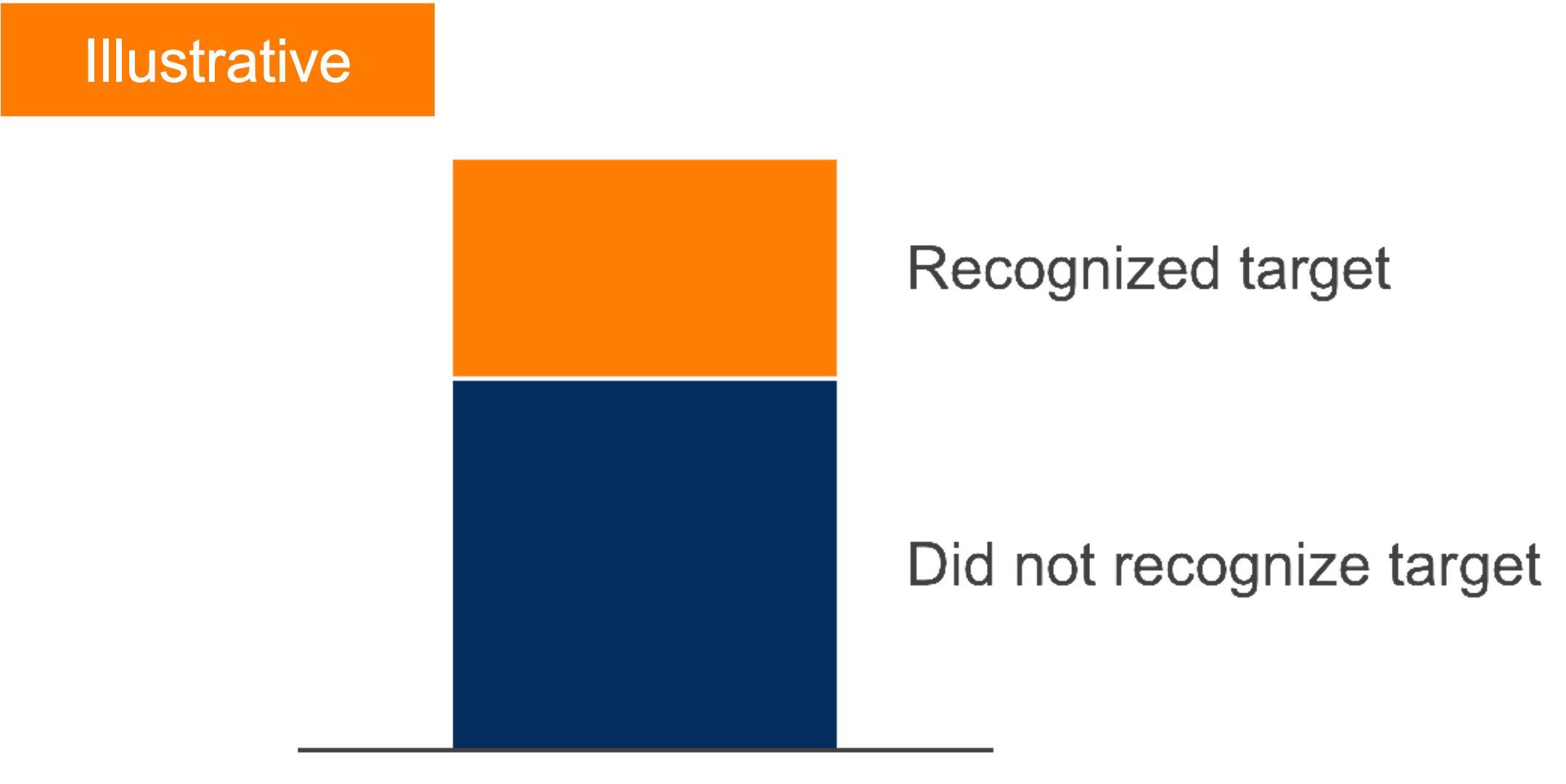

To understand the target’s brand perceptions among customers and its positioning, we spoke to buyers of the target’s main service.

We answered questions such as:

- What is the level of awareness of the target among potential buyers?

- If a buyer needs to remove the hazardous material from their buildings, how likely are they to hire the target company?

Chart 3. Target recognition among potential customers

Q: Do you recognize the following players in this market?

4. We identified and evaluated potential growth opportunities

Because of the nature of the target’s service offering, an important part of this engagement was to find potential growth avenues.

Building services have many adjacencies. Our goal was to find the ones that made sense for the target:

- What are the industries that the target could pivot to in the future?

- What assets could the target possibly acquire in order to build out a new service offering?

We validated each industry and determined ways they could further branch out, based on a set of criteria such as easiness to enter and level of competition, to name a few (see Table 1).

Table 1. Potential growth avenues

Outcome

Our assessment of the market size, the target’s positioning, and its adjacency opportunities validated the attractiveness of the environmental contractor.

This commercial due diligence provided the private equity firm with the insights they needed to complete a successful acquisition.

The deal closed, and early stages of the partnership look promising.