Scaling Smarter: Winning with multi-site service businesses

Many of our private equity fund clients own and operate multi-site businesses. Over the years we have worked on chains of everything from orthodontic and dental clinics to hospitality to HVAC and home restoration. There is a huge opportunity for value creation by providing these businesses with scale and sophistication they don’t otherwise have access to, managing them to maximize cash flow, and benefiting from multiple arbitrage. Some sectors have definitely been picked over substantially, leaving fewer quality targets at reasonable prices. But new sectors emerge, and even in more mature sectors, there is often some fragmentation left, regions that have not been rolled up, and new players who emerge. While the path gets harder, there is opportunity for operators who do it right.

While the term “rollup” can be applied to any platform-based strategy that seeks to gain synergy from tuck-in acquisitions, in this series we are focused on local, service-based, consumer-facing businesses. In subsequent editions we will share particular findings on a range of topics including diligence, post-merger integration, marketing and customer acquisition, and more.

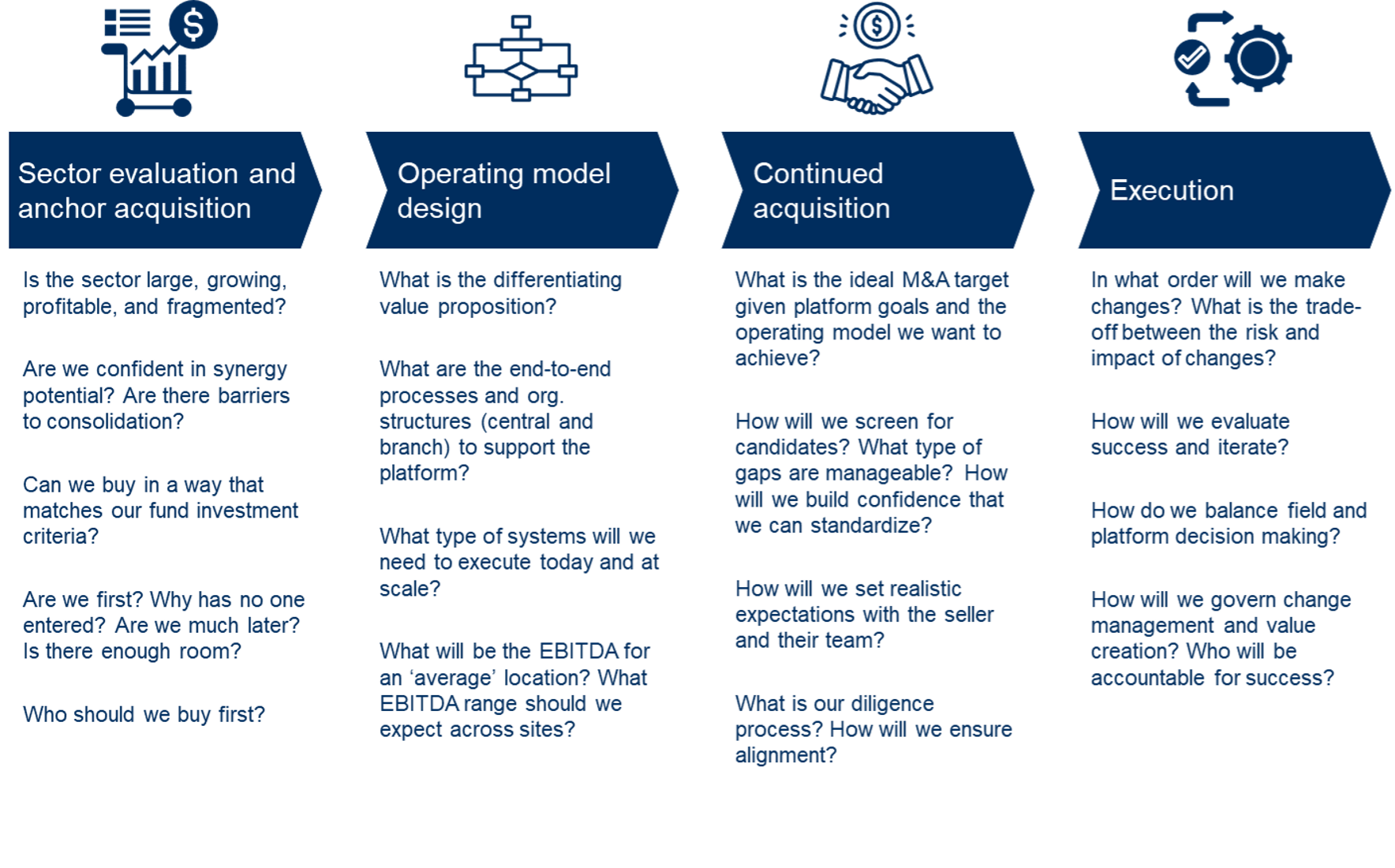

We see funds who focus on these multi-site service platforms execute very well, as they are very deliberate about every aspect of their process from the time they consider and prioritize sectors to the way they operate and govern the model until exit. They invest centrally in tools and systems that apply to all their businesses and leverage talent well across platforms.

Here are a few highlights of what we see the best operators doing:

The process to select sectors is deep and time consuming. They analyze sectors on many dimensions to ensure that the platform meets their investment criteria. They spend time with operators. They think beyond the ability to acquire targets, and into the value proposition of the providers – is there one missing? Are there small players who do it well but have not scaled? Are there better returns linked to operating differently? They make their first acquisition with an eye to understand the sector at a deeper level. Ideally, the anchor has enough scale to be able to lend talent and best practices to future acquisitions.

With the anchor acquired they set out to validate their hypotheses. They work on refining the value proposition, and from there the operating model. They build out a central team and infrastructure that is ready to scale. With a clear plan on what may work and how they want to operate, the new central team can create more specific criteria for acquisitions and then can go hunting for targets.

They acquire businesses that fit the criteria. They have a defined post-merger integration plan, which they communicate clearly to sellers. They assess whether the sellers are really ready for life as a non-owner (or minority partner as the case may be). They walk away from deals where they need an active seller but the one on hand won’t play ball. They remain disciplined about valuation and the diligence process – they know it is better to delay progress by a few months than to buy assets that don’t fit. They certainly don’t want the distractions and demoralization of an early troubled branch or three.

They work to integrate and operate the assets. They have the right systems and tools in place to monitor progress and course correct. They iterate the model as they learn what is working and isn’t.

Here are a few risks and watchouts:

We don’t think it always works that well. There are so many things that get in the way to disrupt the model.

When the first acquisition (or first few) isn’t right, so much can derail the plan further from there. Diligence is harder to get perfect when small owner-operator businesses are acquired, so the chances of accounting irregularities are high. If the numbers are off with the first acquisition, especially if the multiple was higher than expected, managers at the fund level will scrutinize heavily.

Refining the value proposition can get harder if the first asset is not on target – it is really important to determine what was wrong about the whole hypothesis versus what may happen to be wrong with this asset. Spending extra time on the operating model before beginning with other acquisitions can be really helpful.

When the acquisitions start to happen at pace is when the risk starts to mount. With pressure to meet revenue run rates by certain milestones it can be easy to pay too much, skip diligence steps, or make a deal with a founder who is ready to sell but not ready for a life after the deal. A few branches that are not performing, or have operating compliance issues, creates a whack-a-mole situation that saps the operating team’s attention and can push out the life of the asset significantly to give time to get back on plan. It can also destroy confidence at the fund level to keep acquiring.

The chart below summarizes the ideal process and considerations. Please see this link to a longer document that provides detail along the way.

Stay tuned for our next instalment in which we will do a deep dive on the diligence process.