Formalizing an ESG strategy in the mid-market

The practice of considering environmental, social, and governance issues is more prevalent than ever. Considering a company’s ESG stance is becoming a table-stakes component of overall strategy, rather than a “nice to have”.

But where large companies, and those with ever-present public images, are using clear ESG strategies to assuage stakeholders, the mid-market is not yet doing so. With smaller businesses, often founder led, and especially those operating B2B businesses, less stringency exists around clearly defining and executing an ESG strategy.

Couple this with a litany of frameworks, disparate or difficult to obtain data, and the threat of greenwashing, and it is easy to see why companies may have difficulty aligning on an approach.

Clearly defined ESG strategies continue to gain prevalence in all markets. We’ve compiled a list of considerations and questions that mid-market executives and investors may want to ask as they assess and formalize ESG strategies.

1. Figure out what’s already being done.

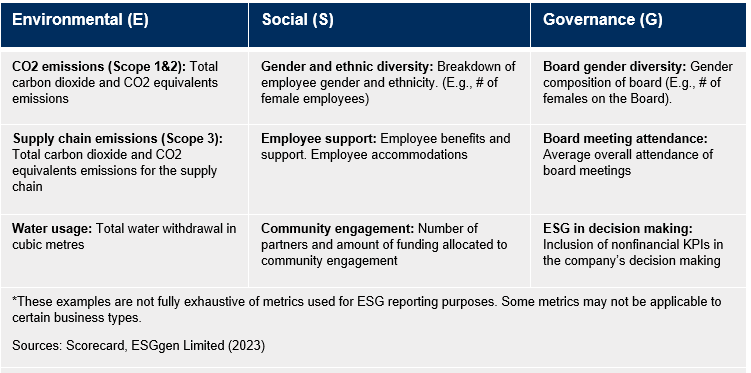

Get smart on the existing ESG practices and gain an understanding of managers’ views. Look beyond company policy to see if any action is being taken. A thorough assessment will reveal whether ESG has been prioritized in the past and is being actioned today. Additionally, conducting an ESG scan has the potential to uncover material risks to the business. Topics of exploration could include diversity in the workforce, workplace culture, and CO2 emissions impact.

What is being formally enacted today? Who is accountable? What is the end goal?

What is being informally done today? Can and should it be formalized? Celebrated?

2. Collect hard data.

Uncover the reporting done today on anything related to ESG (e.g., emissions, diversity data, compensation, etc.). Determine what’s readily available and accurate, what takes effort to unearth, and what’s unavailable or unreliable. Doing so will provide clarity where additional support will be required to draw a holistic quantitative picture of the company’s ESG footprint.

3. Survey stakeholders.

Take a pulse of everyone in the firm’s sphere of influence. It’s important to determine which of your stakeholders value specific components of ESG (e.g., emissions reduction, diversity, labour practices, etc.). Moreover, surveying stakeholders provides perspective as to how they believe the company is performing on key ESG areas, whether it matters to them, and how the company compares to peers.

What is management’s approach to ESG? What are the tangible changes they’re looking to achieve today? How did they decide on what initiatives to enact?

What do our employees think of our ESG efforts today? Are management’s priorities aligned with the views of workers? Where are the gaps and how can they be addressed?

How do our customers and suppliers view our organization? Do they have a perception of our company on the topic of ESG? What, if any, risk to our performance and supply chain exists?

4. Benchmark ESG performance.

Benchmark ESG performance against industry peers with respect to the data collected and initiatives already in place. Results can be used to establish an ESG “starting point,” which is integral to setting realistic and achievable goals.

In which areas are we industry leaders? Are these areas defensible? What can we do to maintain our lead?

Where do we lag our peers? What is the lift required to catch up? To exceed? Will the changes necessary be material to our current business operations?

5. Define goals.

Establish and codify ESG goals and their associated time horizons. Companies will need to lean in to different ESG metrics to reflect their operations. Manufacturers will likely need to be more critical of their environmental footprint than service providers. During this step, reference any gaps identified in the previous steps, and have a facilitated discussion with managers to set appropriate targets. Alignment at the outset will ensure realistic targets with attainable timelines.

What do we need to do right away to reach parity with our peers? What’s most pressing to our stakeholders?

Where do we need to plant seeds for future changes which will impact the long-run sustainability of our business?

6. Decide on a framework.

Select the framework(s) most relevant to the situation and goals. The breadth of options is vast and growing, so a good place to start is to align reporting with peers. Moreover, it’s important to consider the applicability of the frameworks to potential regulation, and the resources (time, human capital) that will be required to continually report.

7. Establish accountability.

Build the proper infrastructure to support your ESG goals and the associated reporting. Ensure that the right leaders are assigned the targets and underlying initiatives they’re capable of achieving. Confirm that the right people and processes are in place where accountability already exists. Where it doesn’t, build the RACI matrices and establish clear processes for communicating progress against goals and initiatives. Finally, review the incentives of accountable parties to ensure that it’s in their best interest to carry out ESG initiatives.

What accountability already exists for ESG targets? Is the right person accountable? Are their incentives aligned with their targets?

Where do we need accountability? How do we incentivize new ESG targets? How do we assign accountability so that leaders are able to influence the metrics for which they’re responsible?