Canadian Credit Unions: Charting a course toward long-term resilience and relevance

Credit Unions play an important role in providing value and choice in our financial system, particularly as the banking industry consolidates even further. Arguably, they have created an outsized impact beyond their relatively small footprint by:

- Leading on member experience, financial inclusion and financial wellness

- Delivering value through innovative and affordable banking products and services

- Setting new standards for sustainability and social impact

- Demonstrating technology and operational agility, punching above their weight in many areas

- Maintaining solid overall financial stability

Today, Canada’s credit unions are navigating an increasingly complex environment as they seek to ensure long-term sustainability through greater scale, resilience and relevance.

This article will be the first of several that summarize key issues facing the Canadian credit union system (with a focus outside of Quebec) and highlight opportunities to unlock as much as $600M in system-wide value to share with or reinvest in members. A key question we will unpack is whether it’s more critical to focus on gaining scale (“we have to get bigger to get better”) or driving improvements in value proposition (“we can build better with what we have”). Through follow-on installments, we’ll dive deeper into specific opportunities and outline practical considerations.

System-wide challenges

What keeps credit union leadership teams awake at night? The following are common conversation topics among credit union executives, analysts and advisors.

Member demographics

Credit union systems around the globe are consistently known for their appeal to older demographics or historical strength in small urban or rural communities with slower population growth. That said, this trend is particularly acute in Canada where 59% of members are over the age of 55 [1]. This type of situation materializes and persists over years or decades and, as such, this shift is not likely to reverse directions quickly or easily. Against these headwinds, membership has still grown at about 1.2% per year since 2019, compared with 1.8% for the Canadian population [2].

Margin and competitive pressures

Financial performance trends have been mixed across the Canadian system. Return on assets declined from 52 basis points in 2022 to 23 basis points in 2023 across Canadian provinces outside of Quebec [3], and results in 2024 remained similarly depressed owing to interest rate and inflationary pressure (with wide variation across regions and credit unions). Over the same period, the big-5 banks’ retail units saw more limited declines (117 to 107 basis points [4]). Bank vs. credit union comparisons between returns on assets should be taken with a grain of salt but diverging trends suggesting that credit unions are facing more pressure or instability. Attention may soon shift toward credit quality to the extent that cracks in their loan portfolios emerge with global trade uncertainty and likely recession.

Meanwhile, it is increasingly difficult to attract and retain low-cost consumer deposits that fuel balance sheets. Canadians have more choice through big banks, challenger banks, or tier-2 lenders and others that are increasingly sourcing consumer deposits with a focus on rate. At a time when credit unions urgently need to a renew their value propositions, this margin pressure and volatility makes it challenging to reinvest in compelling product and service offerings or maintain competitive rate and fee structures without tackling non-interest expense and non-interest income head-on.

Technology and regulatory demands

On top of a sustained shift towards digital channels, payments modernization is in-flight in Canada and open (or consumer-driven) banking standards are slowly materializing. While this is welcome news for consumers and businesses, preparedness to leverage new technologies will continue to ratchet up required investments.

Increasing harmonization between provincial and federal/international standards and elevated expectations for AML compliance, fraud detection, regulatory and tax-reporting, etc. over the last 10+ years have necessitated a step-change in oversight effort and investment. OSFI’s introduction of a regulatory pillar dedicated to integrity and security (e.g. cybersecurity, fraud, and data privacy) will safeguard financial institutions and their customers but add new layers of cost and complexity. Even if regulators have endorsed the principal of proportional regulation, it’s difficult to imagine a scenario in which a $20B provincial credit union carries only “one one hundredth” of the regulatory load relative to a $2T schedule 1 bank.

Given what’s coming at technology and risk executives today, the challenge isn’t only about cost but also about having the depth of expertise to navigate increasingly complex issues.

Constraints to building scale

Despite a recent pickup in merger discussion and activity, credit union consolidation continues at a modest pace in Canada. During interviews more than ten years ago, credit union executives across the country suggested that we would see at least one or two $50B credit unions emerge by 2020. In 2025, it feels like that milestone might still be five or more years away. Reality has fallen short of expectations owing to obstacles to inter-provincial mergers, lack of a clear payback from pursuing a federal charter, and hurdles around aligning on terms with well-suited merger partners or realizing the benefits embedded in merger business cases. Looking ahead, there are likely to be more catalysts and increasing pressure to accelerate system consolidation, given the trends noted above.

Adding it up

Stepping back, if the above headwinds are widely known, and the need to modernize through greater scale and efficiency is generally accepted, why are we continually discussing the situation? Ultimately, the forces in place to drive transformational change in the credit union system do not appear sufficient to overcome sources of friction that impede it.

In part, an oligopolistic structure fosters a slow-to-innovate banking industry, contributing to a false sense of security that yesterday’s playbook will continue to meet the needs of members today and tomorrow, or that there will be time to play catch up. In tandem, the task at hand for leaders is not straightforward, with the need to align diverse stakeholder groups including credit union boards, centrals, regulators, industry peers, third-party solution providers and members, too.

There are many progressive and persevering credit union leadership teams working hard to advance their member value propositions and create sustainable business models; they have their work cut out for them.

Imperatives for credit unions

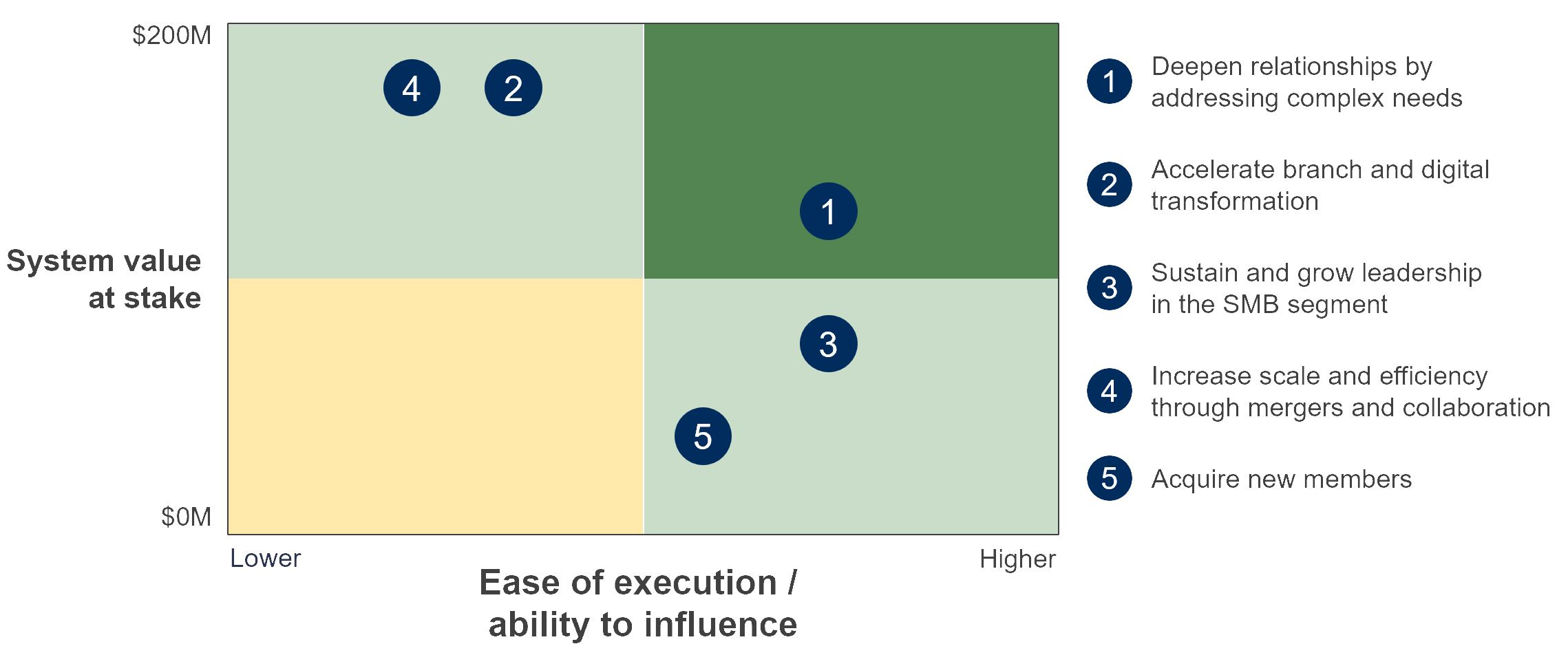

Against a backdrop of growing demands and persistent financial pressure, credit union leadership teams understand better than most the importance of making deliberate choices on where to focus already-scarce resources. With that in mind, we have considered five specific areas of opportunity and estimated the potential system-wide value at stake for each of them. Collectively, these opportunities amount to roughly $600M in potential annual value for members; for reference, credit unions outside of Quebec averaged annual profits of about $1B before taxes and distributions over the last five years [5]. Unlocking this potential will enable credit unions to reinvest in their product and service offerings, share economic benefits directly with members, or extend their community investment and social impact.

Chart 1. Credit Union opportunity assessment

1. Deepen relationships by addressing members’ more complex needs: $100-150M

Credit unions are well positioned to translate high levels of member loyalty into deeper relationships by providing more comprehensive advice. In Wealth Management alone, credit unions have the potential to advise as much as $50B in additional member assets. Growing share of wallet – in a way that builds member financial confidence – is easier said than done given demands on frontline teams, so credit unions need to build the capacity, capability and coordination to do so.

2. Accelerate branch and digital transformation: $150-200M

Digital channels have been the new source for “walk in” traffic for over a decade now. Credit union leaders have responded to this shift but there is more to be done to retool experiences and align channel investments. In addition to sustaining shifts in branch formats, roles and staffing, credit unions need to create stronger and more efficient connections between assisted and self-serve channels to maximize the collective value of each individual channel.

3. Sustain and grow leadership in the Small and Midsize Business (SMB) segment: $50-100M

Credit unions have historically excelled by providing wider access to credit and maintaining strong local relationships. These attributes still matter, but large banks are narrowing the gap and small businesses have new alternatives to manage their finances. Credit unions need to curate a wider range of financial management solutions for small businesses to defend their leadership position and build share in the midsize segment where they have more room to grow.

4. Increase scale and efficiency through mergers and collaboration: $150-200M

Few would debate the importance of mergers to long-term value creation and sustainability. At the same time, there are limits to scale benefits and it’s hard to capture the full value embedded in business cases while navigating a major transition, so credit unions need to revisit and refresh their merger playbooks. In this context, systemwide collaboration will remain another necessary – though sometimes even more challenging – lever to make the most of their combined scale.

5. Acquire new members: $25-50M

Many prescriptions for credit unions focus on attracting more Gen Z consumers, with whom credit unions’ purpose-driven mission should resonate. However, the day-to-day experience for digital natives needs to back up marketing messages and there is work to be done vs. digital-only banks. It’s ill-advised to turn-off the tap on new member acquisition, but there is a risk of targeting demographic segments that won’t (for now, at least) yield a convincing payback over the next few years.

Bigger vs. better

Based on this high-level analysis, should credit unions focus primarily on “building a bigger mousetrap”? The short answer is yes… to the extent system participants can chart a course to $50B in assets, or better yet $100B. If so, the time, cost and complexity to execute mergers will create meaningful efficiency gains that not only improve system resilience but also free up capacity to invest in stronger member value propositions. If the most viable path amounts to slow, incremental consolidation, many larger credit unions will be better served dedicating time and energy to the first three opportunities outlined above. These avenues are generally more centred on “building a better mousetrap” and can deliver clear benefits with increased speed, control or certainty.

As always, one-size-fits-all answers are hard to come by. For instance, smaller credit unions <$1B in assets or those staring down a core banking transformation will be more likely to put mergers on the to-do list. The point of this analysis is less to provide a single answer that applies equally to nearly two hundred diverse credit unions, and more to reinforce the importance for credit unions to shape their strategic plans by adopting a mindset that is just as focused on member value as it is on member values.

Finally, as one of our team members would say, this is all just “fun with numbers” without a practical plan to create and capture value. To that end, we will unpack these areas of opportunity in future installments with additional detail and practical considerations for credit union leaders.

Notes and sources:

- Ipsos Reid Customer Service Index (CSI) Survey, 2021

- CCUA and Statistics Canada quarterly reporting, Q4-2019 to Q2-2024

- CCUA and FSRA reporting

- Canadian bank 2024 annual reports for BMO, CIBC, RBC, TD and Scotiabank; reflects results in the personal and commercial banking segments for each bank

- CCUA and FSRA reporting