Article by Jeff Swain, SATOV Consultant

Our take on why the financial industry is making a mistake by going millennial crazy

Wealth management publications are rife with discussion on the topic of millennials. Scrolling through any recent publication on industry trends you will find a loud and clear message: millennials are different, and marketers need to adapt now!

Seemingly to reach this fresh crop of new ‘investors’, firms are improving their digital presence, strengthening mobile apps, launching online brokerages and more importantly shifting their messaging to be more millennial focused.

With Canadians embarking on the largest inter-generational wealth transfer ever ($750B over the next decade according to CIBC)…there is a big prize to be won for sure. But while millennials will surely stand to benefit – what about the generation that’s going to receive the money first? Shouldn’t the firms be more worried about boomers than ever?

Follow the money!

Here in Canada, wealth is increasingly concentrated within the older population. As a Maclean’s study has pointed out, back in the 1980s the typical senior had four times the wealth of those in their 20s. Today seniors are nine times as wealthy as the twenty somethings. Nine times!

With ‘the great asset transfer’ that is about to unfold, the majority of the $750B will be passed on to the boomer generation. After the transfer the boomers will increase their asset position by an average of up to 20{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748}. This means that those with money to manage will have more to manage AND there will be a whole new crop of boomers with money to manage. Imagine a boomer who earns $50K per annum and then suddenly inherits 100 or 150K…they move from ‘paying the bills with little to spare’ to ‘nice nest egg building and needing investment options’.

So who are these ‘boomers’ anyway?

Canadian boomers are generally classified as those born between 1945 and 1966. Due to the technological innovations that occurred during their lifetime, they were the first generation to experience advertising on a mass-scale, developing consumeristic attitudes supported by a relatively strong economy. A combination of pension expectations, improved social programs over their life time, and a relative comfort with debt led to a generation who put a lower focus on saving for retirement than their parents.

Being between the ages of 51 and 72 many are in, approaching or planning for retirement. Those who are working are likely earning peak salaries, but are also burdened with high debt loads. These issues can be further complicated by rising health care costs as they support their aging parents, and unexpected costs from supporting millennial children who are living at home and struggling to find stable employment.

On the other hand, there is an influx of capital coming. While many are still paying off mortgages, housing prices have risen substantially in many regions, increasing the value of their assets. Business owners are selling off their businesses, generating large levels of cash to invest. And again, many will be receiving large inheritances from their parents. While there is variability across provinces and income levels, the average inheritance over the past decade was as high as $180K in Canada, and the total money to be inherited over the coming decade is predicted to be 50{a23d3e3aff46d689b50c88cc1d7606a7a28ed4b695b585c6bb0ea43784184748} greater.

Boomers are working longer and living longer and healthier lives. They want to travel and enjoy themselves in retirement, but also want to leave an inheritance for their children. As retirement looms, their financial needs are becoming more complex.

To attract and retain boomer clients, wealth managers need to adapt product and service offerings to meet their evolving needs. Clients will be looking for tailored services that suit the unique needs of their household. As boomers plan for retirement, investment management will need to be complimented with a range of services, including financial planning and budgeting, retirement income generation, effective tax strategies, estate planning, succession planning, and insurance, to name a few.

That was easy; create a ‘boomer’ offering, right? Not so simple….

Like other demographic segments, boomers have many things in common with each other, but age (or even age and wealth combined) does not define a person’s needs or attitudes.

Consider Colleen, Paul and Amir. Colleen (age 55), is a real estate developer from Vancouver who expects to work another 10 years, and is comfortable using leverage to finance upcoming real estate opportunities. Paul (age 70) is a retired construction foreman from Hamilton with a strong pension who is looking for fixed income strategies that will enable him to live comfortably through his retirement. Then there is Amir (age 60) who holds a management position at a software development firm in the GTA, and is looking to build a retirement plan as he approaches retirement at 65. While all are boomers, their investment needs and behaviours are all certainly unique, and they would surely respond to different sets of product and service offerings.

In addition, attitudinal variants are extremely important to building offerings and are often ignored by service providers. Do they have a lot of friends, do they enjoy socializing? How important is social connection when doing business? How do they think about value and price, and their interaction? Do they like to do things themselves? What channels do they prefer to use and for which services? How frequently do they want to interact? What is their level of risk tolerance? How comfortable are they with new technologies?

The firms who will win will balance marketing the financial needs of the boomer segment, while showing an understanding of the unique needs of individual clients. Recent examples include BMOs recent ad promoting “a plan as personalized as your coffee,” or the recent HelloLife campaign by Great West Life.

Serving boomers doesn’t necessarily mean maintaining the traditional face-to-face, appointment based model of the past. As an example, robo-advisor firm Wealthsimple has recently launched its Black product, offering custom financial and tax planning services aimed at serving older, higher net-worth customer segments.

So what should we do now?

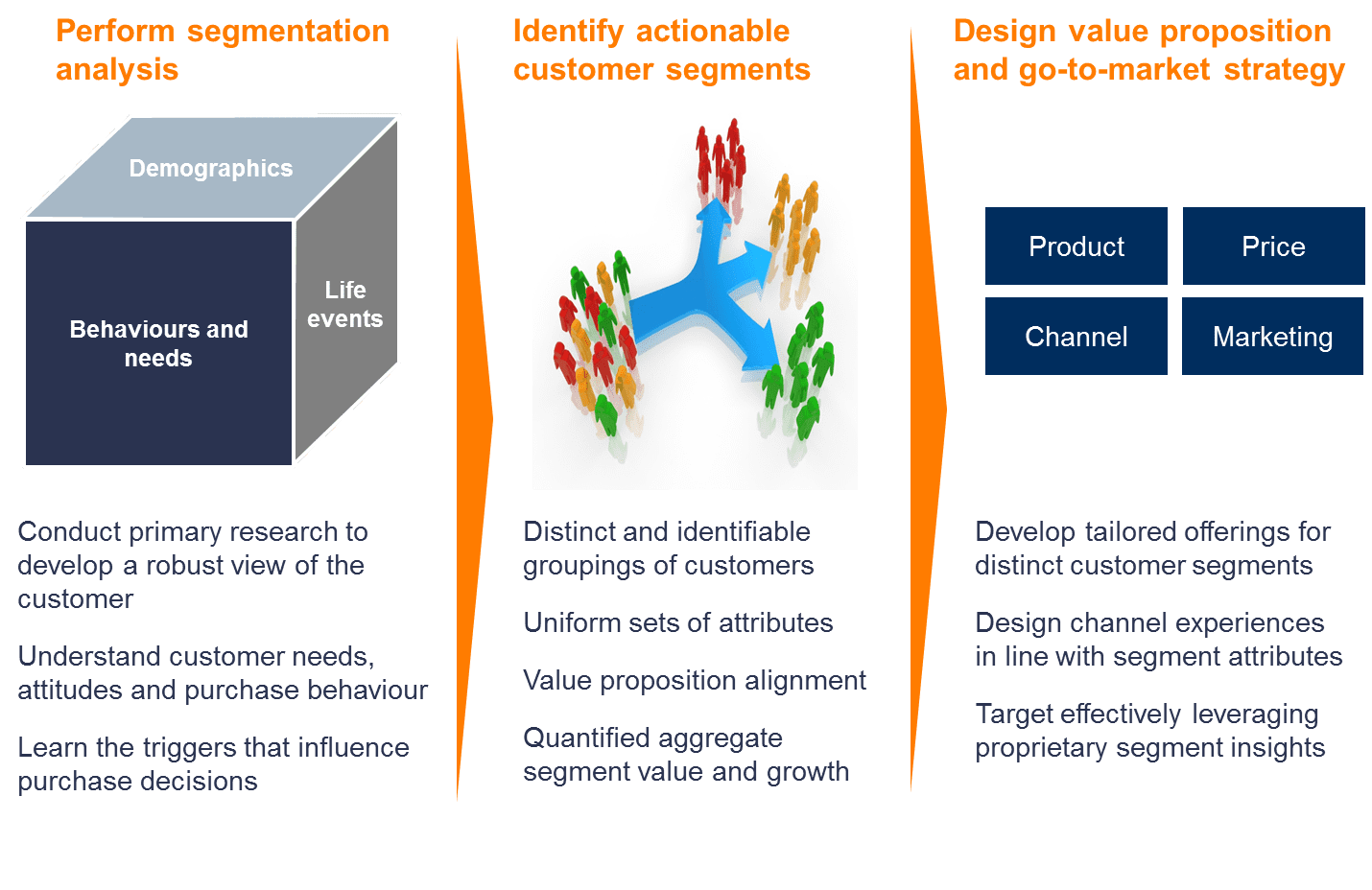

The first step involves getting to know your clients and prospective clients. Engage them in discussions about your services, distribute surveys, hold some focus groups – get your hands on some primary research! You can also gather valuable insights from your front office staff who interact with clients on a regular basis. Use our segmentation cube (see Figure 1) as a guide to ensure you are collecting well-rounded data that goes beyond pure demographics.

Figure 1

Run your data through a statistical analysis to logically group clients into meaningful segments with a uniform set of attributes that can be used to inform your customer strategy.

Identify which segments are most attractive to your business. Consider the size and growth of each segment, but also how your value proposition stacks up. Which segments are you best positioned to serve with minimal adjustments? Where are your gap areas? How is your brand perceived by each segment?

Finally, use the insights you have gained on each target segment to guide your product and service design, go-to-market strategy, and marketing strategy for attracting new clients.

Targeting the boomers doesn’t necessarily imply maintaining the status quo. Unlike their parents, many boomers are more comfortable with digital tools and continue to adopt new service models. With a firm understanding of the unique attributes of your target segments and value proposition to back it up, your business will be boomering!

Third party sources:

- CIBC – The Looming Bequest Boom — What Should We Expect?

- Macleans – Seniors and the generation spending gap

- BMO – a plan as personalized as your coffee

- Great West Life – HelloLife campaign