Pot companies get all the press these days, but consumer packaged goods companies can quietly become dominant players in this evolving space. Sam Puchala and Maya Silman put together this informative view.

Cannabis and CPGs

You know cannabis has popped when even Jack-in-the-Box gets onboard.

Last year in California, where recreational and medical marijuana are legal, the U.S. fast-food chain rolled out the weed-themed Merry Munchie Meal. Hardly a corporate rebel, Jack-in-the- Box cooked up this offering with Merry Jane, a pot-focused digital media company founded by rapper Snoop Dogg.

In Canada, with recreational legalization looming, big consumer brands are also making cannabis-related moves. Oh Henry! has launched the 4:25 bar, a regular chocolate bar marketed to people with the munchies. Then there’s Coca-Cola, who has recently signaled interest in CBD infused drinks; and Molson Coors, who has joined forces with marijuana company Hydropothecary to develop non-alcoholic drinks infused with cannabis. “This bud’s for you”—oh, right, that’s already taken.

The cannabis opportunity is not only for alcohol purveyors and corporate dare devils. There is a huge opportunity for consumer-packaged good companies (CPGs) as well. A few are already starting to take notice, and in our opinion, many of the rest should start to follow suit.

Back in 2001, Canada was the first country to legalize medical marijuana, and on October 17 it’s making recreational use legal. As public acceptance of cannabis grows, CPG brands willing to be bold first movers can tap into a big opportunity. With expertise in manufacturing and distributing food and beverages at scale, CPGs are a natural fit for a multibillion-dollar market that will soon include edible products (estimated to become legal in July 2019). If they do their homework, CPGs can have cannabis users eating out of their hands.

The market will be big

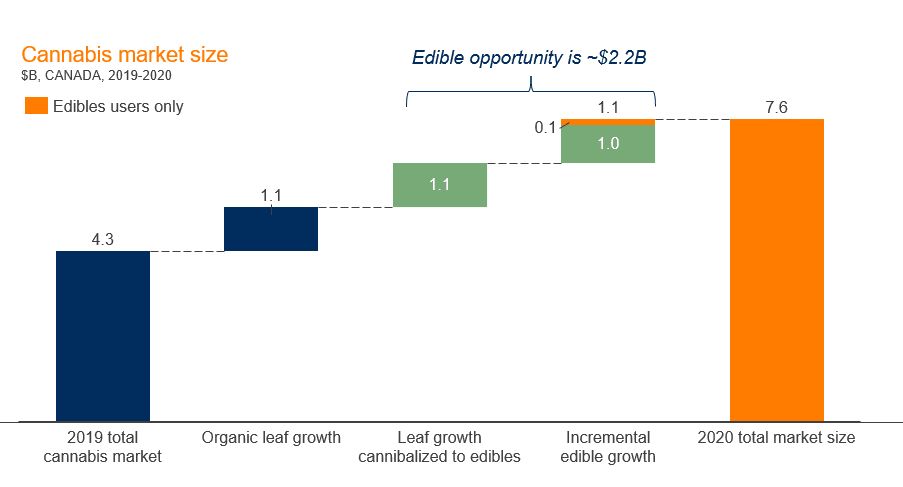

The edible market will be material for large CPG brands. The Canadian legal marijuana market will be about $4.3B in 2019 and should grow 52% to $6.5B billion by 2020.[1] Edibles, once legalized, are expected to be a sizable portion of that. We estimate that edibles can grow to be a $2.2B opportunity in 2020, far outstripping other CPG markets such as retail coffee ($1.4 billion) and chocolate ($2 billion).[2] (See Exhibit 1)

Exhibit 1:

Source: Deloitte, CIBC, SATOV analysis

Good news from the US

In California and Colorado, where recreational marijuana has been legal for 2 and 6 years, respectively, legalization has been mostly a success. Among the positive results: state governments have collected hundreds of millions of dollars in new taxes, youth cannabis usage hasn’t climbed, DUIs have declined, opioid overdose-related deaths have fallen, and the industry has created over 200,000 jobs.

Most of the issues so far have revolved only around implementation (e.g. logistical issues, pricing tension between illegal and legal sellers), an expected challenge as players navigate a new and rapidly changing retail and regulatory landscape.

It is reasonable to assume that Canada will have an equally positive experience following legalization and that legal cannabis is likely here to stay.

Edible penetration will likely increase following legalization. In Colorado, edibles grew from 18% of total cannabis sales in 2014 to 38% in 2016.[3] While a portion of that came from new users, around 18% came from smoker cannibalization, meaning users switch from smoking to eating (Exhibit 2). Canada will likely see a similar shift. “Eventually half the marijuana sales in Canada will be of ingestible products, from baked goods to oils” says Cam Battley, VP of Aurora, one of the largest cannabis producers. [4]

Exhibit 2:

Source: Huffington post, SATOV analysis

Stigma? What stigma?

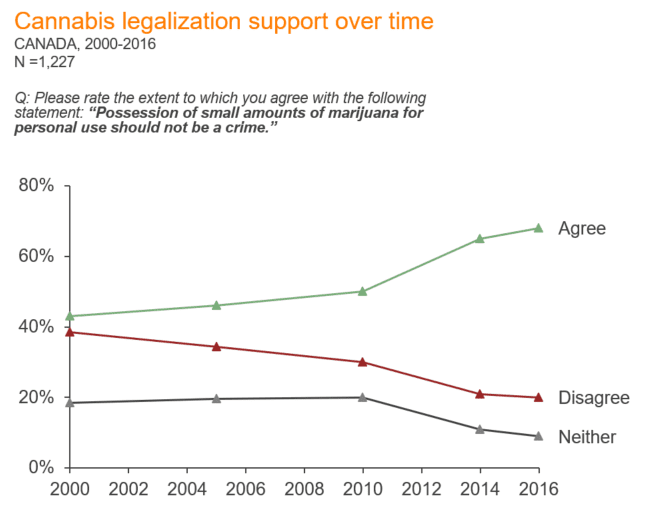

Over the last 10 years the stigma around cannabis has continued to decline and Canadian support for legalization has continued to rise (Exhibit 3). Currently at least 67% of the population is in favour of or indifferent toward legalization, including 51% of non-pot users.[5] It therefore seems unlikely that big CPG brands moving into cannabis will be materially impacted by stigma to the detriment of their core business.

Exhibit 3:

Source: IPolitics

The industry has already begun a rebrand of the cannabis space. The language is shifting from words like “pot” and “weed”, associated with the “stoner culture”, towards the word “cannabis”, a word associated more with upmarket products and health and wellness.

Although some disapproval remains, the stigma around cannabis should continue to decline as the legalization process continues, similar to what happened with alcohol. In 1927, when prohibition ended, there was still a significant stigma against alcohol consumption; the purchasing process itself was difficult and designed to be shameful. It took many years for widespread public approval and almost seven decades to allow alcohol to be sold over the counter, but now alcohol is a part of everyday society.

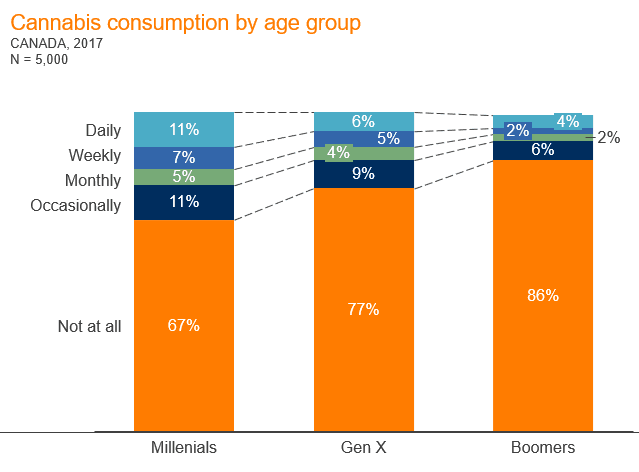

There is a clear difference in usage and support amongst age groups (Exhibit 4). Millennials are the largest group of cannabis users, so it stands to reason that brands geared to them will have the easiest go. Having said that, age is only one relevant dimension by which to segment consumers in this space. Brands should understand at a more detailed level who they cater to today and who they want to attract in the future when they make the decisions around entering the cannabis market.

Exhibit 4:

Source: Deloitte

What are you waiting for?

Big CPG companies have yet to leverage their pre-existing brands to enter the cannabis space, which remains uncharted territory for major players. While smaller and more niche entrants attempt to build a new brand from the ground up, established CPGs can make the most of their current market position and resources to jump ahead.

So far, the alcohol giants have been the primary big movers, investing in products to prepare for the day that edibles (including weed-infused beverages) become legal. The move by alcohol companies is both a hedge against shrinking alcohol sales and an opportunity to capitalize on the many marketing, distribution and other synergies between the two vice businesses.

Before edibles become legal, companies that want to get a taste of the market should consider pot-free brand extension products, like the O’Henry 4:25 bar. Entering the market with a regular product that has a cannabis marketing focus is a good way for CPGs to test brand positioning and market reception before entering the market with edibles.

Know your customer

Entering the space may not be the right opportunity for all CPG brands. Brands that are weighing an entry into the cannabis market need to ensure their customers not only want these products, but that they want these products from them. Some companies may decide to enter the space to leverage their infrastructure and channel relationships but use a separate brand altogether.

CPGs will want to understand their various customer segments and their perceptions of cannabis. They will want to ensure they retain their most loyal customers. They will also want to understand the behavior of their next-tier customers and their propensity to increase or decrease loyalty based on these new products.

- How old are most customers today?

- What percentage of customers currently use or plan to use Cannabis products?

- What percentage of customers have disapproving views?

- What are customers’ various cannabis use occasions?

- How many new or existing customers are interested in purchasing these products?

- What is the family unit and size of customers? What is the range of views in the family?

We spend a lot of time debating the valuations of the big three pot producers and try to estimate the impact to the alcohol business players. Most of these ‘vice players’ have a future that is very hard to predict: who will make it? How big will they be? How much will their core business fall while their new business grows? But CPGs have a lot more upside than downside with munchy snacks moving up in volume and edibles providing net new opportunities. If they play their cards right they can be the big winners.

[1] Deloitte, CIBC

[2] Coffee Association of Canada, Ibis world

[3] Huffington Post

[4] Ottawa Citizen

[5] Cannabis life network